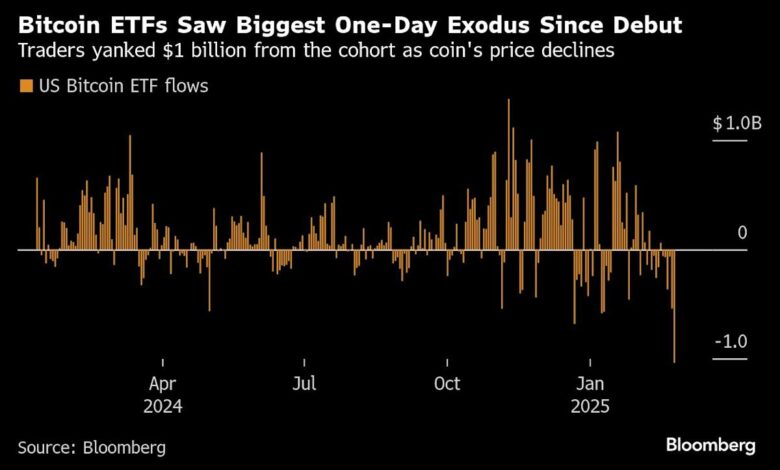

Bitcoin ETFS is hit with outflow of $ 1 billion in one day

(Bloomberg) – Investors on Tuesday Tuesday Tuesday, marking the biggest outflow to maintain the largest perfectly perfectly perfectly great great great outflow since last January.

Most reading from Bloomberg

The BitCoin Fund for Loyalty Fund BitCoin (Ticker FBTC) has published the oldest outflow between these funds, and then isheres Bitcoin Trust ETF (IBIT), according to the data that put together Bloomberg. This is that the price of bitcoin decomposes, with investors who have risky funds in the face of insecurity. As a group, Bitcoin funds shed approximately $ 2.1 billion over six consecutive days – the longest part of the outflow since last June.

The largest digital property in the world came under pressure this week, and its price is tone to the lowest level since mid-November, after it hit all the time at the beginning of this year. Other cryptocurrencies are also disappeared, with the monitoring index of top digital tokens at the pace for its highest four-day decline since the beginning of August.

Although Bitcoin funds see that exodus, investors used recent stocks to add almost 7 billion dollars combined in one sitting in Invesco KKK Trust (KKK) and SPDR S & P S & P 500 ETF Trust (SPK).

“Digital property is still very guided by retail, despite institutional flows in the past 12 months,” said Geoff Kendrick, Global Head Digital Research Property on Standard Chartered. “This sets them from capital and fixed income. In my opinion, it means that the average hand is weaker or has less deep loss drive pockets. Therefore, pain is probable.”

Kendrick predicts that Bitcoin will trade even lower – about $ 80,000 – where “I’ll buy DIP” will “

To Matthew Sigel, Vaneck’s head of digital assets, outflow for shooting probably the outflow from Hedge Funds is a popular trading strategy, which is called basic trade, which involves differences between places and futures markets. Some used ETFS to profit from the instability of cryptocurnence or compensation for a brief position in derivatives.

“This strategy involves buying a bitcoin site (often via ETFS), at the same time reducing BitCoin Futures to lock in low-risky return,” Sigel said. “However, the profit of this store recently collapsed, making it far less attractive. As a result, Hedge funds used by ETFS for this strategy probably closed their positions, which led to significant midsetih.”

(TagstotRanslate) Bloomberg (T) Isares Bitcoin Trust ETF (T) Digital Token (T) Digital Asset (T) Investors

https://s.yimg.com/ny/api/res/1.2/jkh3d2NelOj93ZwwEoaH0Q–/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD03NjU-/https://media.zenfs.com/en/bloomberg_markets_842/9956db0c9e1cd68241f308565a1122fa

2025-02-26 21:13:00