Bitcoin in “critical turn” as drives of encryption for a “main” price stimulus

Bitcoin currency and cryptocurrencies have found temporary ground after a high-slope sale.Although an analyst warned the merchants against “buying a decrease.”

Open more than $ 3000 in NFT, Web3 and Crypto Perks – I offer now!

Bitcoin price fell to the lowest level of about 85,000 dollars per bitcoin on Tuesday, a decrease of 21 % from its highest level ever, which is approximately $ 110,000 and put it in the correction area. However, bitcoin wore again The market is preparing to update major legislation Bitcoin Senator Senatia Lomes returns.

now, While traders weigh what the proposed Doug Musk checks can meanAnalysts said that Bitcoin remains in a “critical turn”.

Subscribe now for the free time Cryptocodex–A five-minute news message for traders, investors and Crypto-Curious, which will make you update and keep you advanced on Bitcoin and Crypto Market Bull Run

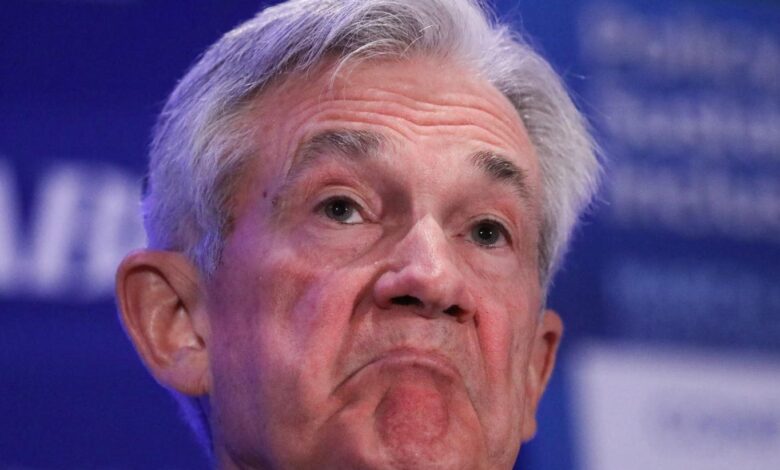

Federal Reserve Chairman Jerome Powell weighs the number of interest rate discounts that the Federal Reserve can make … [+]

Bitfinex analysts wrote in A. a report. “Since the market participants are awaiting an incentive, it is possible that the next main step in Bitcoin will be dictated through macroeconomic trends and may be decisive.”

Bitcoin and the encryption market have stopped in recent weeks, as it struggles alongside the stock market that has been partially blamed for economic uncertainty.

The sale of bitcoin price has led to record funds approximately one billion dollars that are withdrawn from the fleet from the boxes circulating on the Bitcoin Stock Exchange (ETFS)-Paying a prediction by Jeff Kendrick, head of encryption research at Standard Charterd Bank, Which warned that the market still could have a way to decrease.

“I still think the great surrender has not yet come,” said Jeff Kendrick, head of encryption research at Standard Charterd Bank.

US President Donald Trump, who pledged to establish a US Bitcoin Reserve while he was in the campaign campaign, disturbed his threats to definitions, which raised fears that a global trade war may reach asset prices.

“The American economy also faces increasing challenges with weakening consumer confidence and high inflation expectations, which is a possible setback for the Federal Reserve’s progress in controlling price growth.”

The Federal Reserve Chairman, Jerome Powell, was forced to stop the planned price reduction course after its launch with a decrease in half a point in September, as it threatens inflation by theft outside the scope of control.

Meanwhile, the market was paid for the fourth quarter of Boys’s profits from the artificial intelligence sticker after the market closed on the four.

“NVIDIA’s profits will be a major incentive that moves AI, and may raise technology and encryption markets,” Matt Mina, Crypto Transded Fund (ETF).

Subscribe now CryptocodexFree daily news message for encryption

Bitcoin price decreased from its highest level ever, which raised fears that the price of bitcoin … [+]

“There is a lot of discomfort about the future in the short term of technology shares as Big Boy Nvidia is preparing to confront investors,” said Danny Hyuson, head of AJ Bell’s financial analysis.

“What the chips maker about expectations for the next year has the ability to transport markets, especially with a lot of tensions about Donald Trump’s new restrictions on Chinese investment and the small issue of Depsic and its endeavor to bring the new artificial intelligence model to a market.”

Hewson added, “We, the confidence of the consumer is vibrating [and] People are tense about what the next few months can bring [after] Temporary stopping in price discounts. “

https://imageio.forbes.com/specials-images/imageserve/626e4deb9cb7a8fb2aab7720/0x0.jpg?format=jpg&crop=1444,953,×413,y98,safe&height=900&width=1600&fit=bounds