A market in the sea from the red, the bitcoin price has seen diving to 80 thousand dollars

Written by omkar GodBole (at all times ET unless it is indicated otherwise)

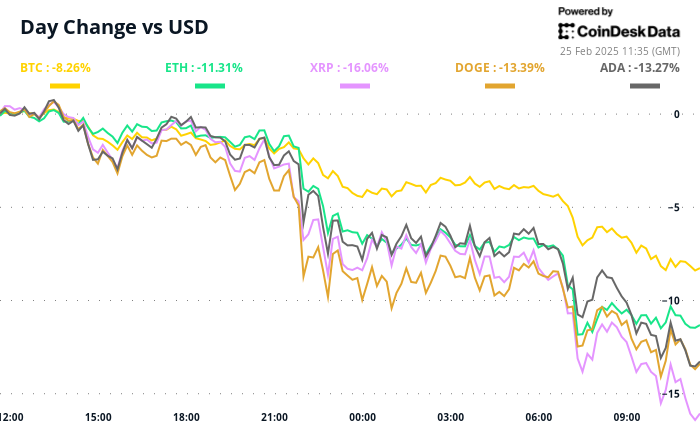

Crypto market is a red sea, where Bitcoin is traded with less than three months less than $ 88,000 and Coindesk 20 index of more than 10 % in 24 hours. There are many stimuli for the wondrous, including risk feelings in traditional markets and the influence of Memecoins, especially the recent trading in Trump and Maldra.

As Discuss MondayThey were a market maker who attended the Hong Kong consensus conference last week, concerned that the mimician frenzy had absorbed liquidity from the producing sub -coding sectors, leaving the wide market.

Another reason is the failure of President Donald Trump. Although he made great promises in the period before the elections, the tangible work was rare. The expected strategic BTC reserves are still absent, and even the state levels prove a challenge for implementation.

“The industry is still waiting for this to appear in a concrete manner in the form of measures such as the strategic reserve of the committed bitcoin,” Peter Quakov, co -founder and CEO of Merindesk. “Meanwhile, the feelings were severely subjected to the largest penetration ever on the Bybit Stock Exchange, 401,000 ETH, and Memecoin, which was afflicted with high -level pump plans.”

Finally, renewed fears about the American economy are renewed from the demand for the most dangerous assets.

“There is also some concern about slowing growth in the United States since the PMI released American Services last week, which is the lowest level in 22 months and is in line with the tracking of GDP only 0.6 %,” said Aureli Batriqi, lead analyst at Nansen. “Our Nansen’s risk scale has also turned into the risk of Neutral today.”

Together, they sent BTC Diving from two months, ranging from $ 90,000 and $ 110,000. Technical analysis theory indicates that it may decrease to $ 70,000, although the maximum open interest in the BTC options listed in Deribit sits at a strike of $ 80,000, indicating that this level can provide some support.

What can prices settle? Perhaps a declaration from Trump on strategic reserves or sharp reflection by NASDAQ 100. However, this fell dollar fell.

The following main incentives for risk assets are NVIDIA profits on February 26 and the main PCE enlargement on February 28. Stay on alert!

What do you see?

- Checks:

- Macro

- February 25, 10:00 am: CEB Consumer confidence index launches in February.

- Consumer confidence CB EST. 102.5 against the previous. 104.1

- Feb 25, 1:00 pm: Federal Reserve Chairman Richmond Tom Parkin delivers a speech Entitled “inflation and then and now.”

- Feb 25, 7:30 pm: The Australian Office for Consumer Prices is launched in January.

- Monthly consumer price index. 2.6 % against the previous. 2.5 %

- February 26, 10:00 AM: The US Statistical Office launches the new residential sales report in January.

- New homes sales EST. 0.68m against the previous. 0.698m

- My previous mother’s homes sales. 3.6 %

- February 26-27: The first meeting of the Financial Ministers in the Group of Twenty and the rulers of the Central Bank (Cape Town).

- February 25, 10:00 am: CEB Consumer confidence index launches in February.

- Profits

Symbolic events

- Voting of referee and calls

- Ampleforth Dao votes on Reducing flash mint fees to 0.5 % Flash fee to 5 % to increase the ability to adapt to the system.

- Dydx Dao discusses Create a DYDX Re -purchase program. Its initial steps will allocate 25 % of the DYDX net revenue to purchase the distinctive symbol.

- Discussing Frax Dao Protocol promotion By rename the FXs to Frax, which makes it the gas code on Fraxtal, the Frax North Star Hardfork app, and the introduction of a tail emission plan with gradual decrease emissions, among other improvements.

- to open

- February 28: Optimism (OP) to open 2.32 % of the trading offer of $ 30.21 million.

- March 1: DYDX to open 1.14 % of the $ 5.36 million trading offer.

- March 1: Zetachain (Zeta) to open 6.48 % of the 2.86 million dollar offer.

- March 1: SUI (SUI) to open 0.74 % of the trading offer of $ 61.32 million.

- March 7: KASPA (KAS) to unlock 0.63 % of the $ 14.02 million circulating offer.

- March 8: Berrachain (BERA) to open 9.28 % of $ 61.6 million in offer.

- March 12: APTOS (APT) to open 1.93 % of $ 69.89 million in offer.

- Distinguished symbol lists

- February 25: Animal Garden (Zoo) to be included on Cocoin.

- February 25: ENA to be included on Bithumb.

- February 26: Monuel (well) to be included on Kraken.

- February 27: The distinctive symbol in Venice (VVV) to be included on Kraken.

- February 28: WorldCOIN (WLD) to be included on Kraken.

Conferences:

Distinguished symbol speech

Written by Shuria Malwa

- The distinctive symbol associated with the fake -fried Sam, the fake Sam, has become the carpet today.

- The fraud of the “Common Guardiagrele” account, a small Italian city with an verified gray mark indicating that it is a government account or an official organization, based on the results of the web to verify the identity.

- The fraudsters may disappear or buy the account and change the name to “SBF_DOGE” simulating Sam Bankan Farid (SBF).

- Then the account launched a mechanical, most likely deceiving traders or robots that are reassured that it was legitimate because of the verification badge.

- Memecoin’s market value increased to $ 10 million before creators withdrew liquidity, and collided with them to $ 100,000 of pocket messages, duties and revenues acquired from the sale.

Locate the location of the derivatives

- The most important 25 encoded currencies according to the market value, with the exception of Stablecoins, have recorded price losses during the past 24 hours. At the same time, most of them have seen increases in open interest in permanent future contracts and negative cumulators, indicating the flow of short homosexual situations. Perhaps there is more pain in the future.

- On Deribit, the XRP expiration ends in February (bean) that talks about the feelings as it is significantly declining.

- BTC, ETH options show the negative side fears until mid -March, while maintaining subsequent violations bias the biological invitation.

Market movements:

- BTC decreased by 6.23 % from 4 pm East time on Monday at 88,118.16 dollars (24 hours: -7.7 %)

- Eth 9.4 % decreased at $ 2,393.03 (24 hours: -10.6 %)

- Coindesk 20 decreased by 9.19 % at 2,750.01 (24 hours: -11.61 %)

- The Staking Ether Cesr rate has not changed at 2.99 %

- BTC financing is 0.0008 % (0.84 % annually) on Binance

- DXY did not change at 106.7

- Gold decreased by 0.28 % at $ 2,937.90

- Silver decreased 0.43 % at 32.14 dollars/ounces

- Nikkei 225 closed -1.39 % in 38,237.79

- Hang Seng -1.32 % closed at 23,034.02

- FTSE increased by 0.34 % in 8,688.48

- Euro Stoxx 50 did not change at 5,449.69

- Djia closed on Monday without change in 43,461.21

- S & P 500 closed -0.5 % in 5,983.25

- Nasdak closed -1.21 % in 19,286.93

- Closed S&P/TSX compound unchanged at 25151.26

- S & P 40 America America closed -0.92 % at 2,386.34

- The ministry of the Ministry of Treasury in the United States decreased for 10 years by 4.35 %

- E-MINI S&P Futures decreased by 0.78 % at 5,981.75

- E-MINI NASDAQ-100 Futures decreased by 0.53 % at 21,306.25

- Medium intermediate futures in the E-MINI DOW JONES index decreased from 0.13 % at 43,479.00

Bitcoin Statistics:

- BTC dominance: 61.81 % (-0.15 %)

- ETHEREUM ratio to Bitcoin: 0.02720 (-0.95 %)

- Retail (seven -day moving average): 745 eH/s

- Hashprice (spot): $ 56.8

- Total fees: 7.5 BTC / 1.3 million dollars

- CME FUTERES Open benefit: 166,510 BTC

- BTC at gold price: 29.7 ounces

- BTC market roof against Gold: 8.42 %

Technical analysis

- The daily chart in BTC shows that the cryptocurrency has sparked a dual -declining pattern.

- The shift in the direction supports the issue to get a long weakness to the simple moving average for 200 days, currently concentrated less than $ 82,000.

Encryption

- Microstrategy (MSTR): Closed Monday at $ 282.76 (-5.65 %), a decrease of 6.35 % to $ 264.81 on the market before the market

- Coinbase Global (COIN): Closed at $ 227.07 (-3.53 %), a decrease of 5.6 % to 214.14 dollars

- Galaxy Digital Holdings (GLXY): Closed at 21.80 Canadian dollars (-4.22 %)

- Mara Holdings (MARA): Closed at $ 13.25 (-4.68 %), a decrease of 5.76 % to $ 13.09

- Riot platforms: closed at $ 9.99 (-4.49 %), a decrease of 5.01 % to $ 9.49

- Core Scientific (Corz): Closed at $ 9.86 (-8.7 %), a decrease of 5.58 % to $ 9.31

- Cleanspark (CLSK): Closed at $ 8.90 (-3.78 %), a decrease of 5.39 % at $ 8.42

- Coinshares Valkyrie Bitcoin Miners Etf (WGMI): Closed at $ 19.20 (-6.43 %), a decrease of 5.21 % to $ 18.20

- Semler Scientific (SMLR): Closed at $ 44.38 (-7.04 %), a decrease of 1.8 % to $ 43.58

- Exit (exit): closed at $ 41.16 (-13.91 %), unchanged in the market before the market

Etf flows

BTC Etfs Stain:

- Daily net flow: -516.4 million dollars

- Cutting net flow: 39.05 billion dollars

- Total BTC Holdings ~ 1,105 million.

ETH ETFS spot

- Daily net flow: -78 million dollars

- Cutting net flow: 3.07 billion dollars

- Total Eth Holdings ~ 3.331 million.

source: Farside investors

It flows overnight

Today’s scheme

- Raydium recorded a cumulative trading volume of $ 1.9 billion on Monday, the lowest level since November 29, according to ARTEMIS.

- The slowdown is partially explained by the last decrease of the code code value and the Solana symbol.

While you sleep

- Bitcoin slides to less than 89 thousand dollars to 3 months, with future contracts declining on the Nasdaq and Yin Sparks risk fears (Coindsk): Bitcoin fell to less than $ 89,000, as the future NASDAC referred to more technological losses and strong yen raised fears of risk hate, similar to August 2024.

- ETFS in the United States Bitcoin Etfs Post Year 2nd-Biggens, where the basis for trade decreases to less than 5 % (CoINDESK): The United States ETF Spot witnessed that ETFS in the United States witnessed $ 516 million in external flows on Monday and the annual Bitcoin CME basis decreased to 4 %, which is the lowest level since the investment funds circulated in January 2024 began.

- Usde Ethena Labs export (CoINDESK): Ethena Labs has strengthened USDE risk management by adopting independent data from Chaos Labs.

- Forget Maga, investors want Mega: Make Europe great again (The Wall Street Journal): Once you fail to American markets, Europe regulates a strong return, as EURO Stoxx increased by 12 % since Trump’s victory, driven by record flows and increasing calls to organizational reform.

- China learned to embrace what the United States forgot: the virtues of creative destruction (Bloomberg): Amid the escalation of the American customs tariffs and the faltering real estate market, China reduces government spending, allowing the weakest sectors to collapse so that resources can turn into technology and innovation.

- Asian stocks slide with the United States’ restrictions on China’s investment, and earn the euro to fade (Reuters): Asian stocks fell on Tuesday amid US restrictions on Chinese investment. The Asia Pacific Index in MSCI fell 1 % and Japanese Nikki decreased by 1.3 %.

In the ether

https://cdn.sanity.io/images/s3y3vcno/production/66ec668359ef0466ffed0afbc130217b8835dbea-700×430.png?auto=format