Regulatory Shift Spii Golden Age for Cripto Pioneer Coinbase (Coins)

Coinbase Global (Coin) Is one of the first companies that people think think about cryptocurlenza. During the last few years, vehicles is a wave of institutional and retail adoption on the back of its trade platform extremely to the end crypto Investors and traders. With solid performance in 2024 yearsThe exceptional story about the company’s growth is hardened according to training trade activities and the increase in the adoption of high margins services such as commitment and detention. Behind the basis of the company, coinbase can now be in the main position to use seismic shift in the American regulatory landscape.

Discover the best supplies and maximize your portfolio:

Next The election of President Trump, policy makers turned towards a friendly attitude on the sector crypto. A recent executive order called “Strengthening American leadership in digital financial technology” appears to be set to establish a clear framework for digital assets and potentially build a national cropto reserve. This move could be a gift gift for companies like Coinbase and in turn make me a coin with a coin bull.

The growing crypto legitimacy helps a coin

We rarely have a quiet week in crypto space, but with a sector proving murk and problematic for many, clear policy initiatives and transparent legislation are necessary for investors looking for stability in industry. The lack of clarity during recent years probably distracted institutional investments and encouraged the mentality of gambling among individual investors. I think structured supervision from the support of the regulator could be the right balance, potentially work on the advantages of Coinbase in three key ways.

First, given the hearings in the US Congress regarding clear guidelines about Stablecoins, I think it develops a well-defined regulatory framework can cause institutional trust, potentially build taverns as a reliable and harmonizing exchange.

Second, coinbass was engaged in a sector search bar, which has been potentially unregistered sales of security for some time. However, a recent move to the American District Judge to continue to make a hope that a definitive conclusion will be reached, not to continue ongoing insecurity. The Appeals Court also ordered that the Dec was explained why the request for Berespit CRIPTO regulations was denied, suggesting that the legal world in some way also harmonizes with the goals of the company.

Last but not least, SEC viewing trend approving various Bitcoin And Solana ETFS gives institutional investors to trust that the crypto market is on the way to be safe, secure and legitimate. With a hook, already well established in the growing crypto market, trading volume will probably grow, and custody fees increase over time.

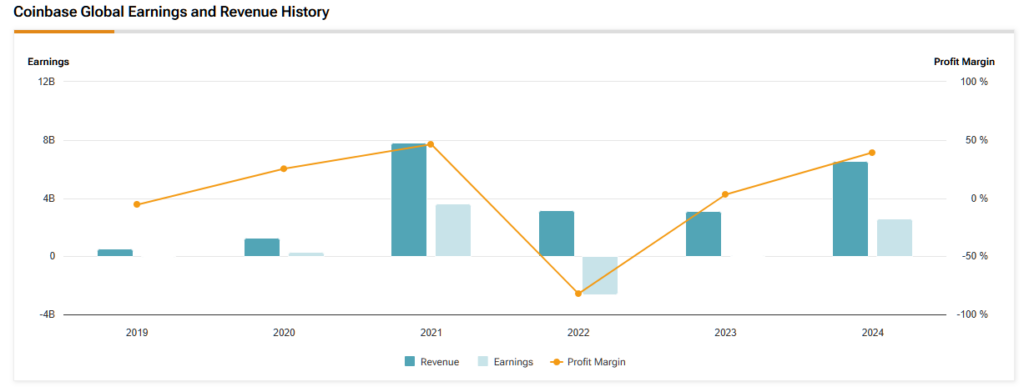

Coin’s business performance shines

In its latest data, the coin impressed with resistance and true success in a challenging and unpredictable environment. While Bitcoin and the wider market increased, management has expanded quarterly income by 172% to $ 2.3 billion. The fast growing segment of services also saw 15% increase to 641 million dollars, with a ropes Premium subscription Premium subscription, showing strong intake.

As the largest regulated exchange in the country, coins remains to be switched to the platform for many American institutions that want to touch the crypto. While contesting in crypting is a fungus, the advantages for the first move, forged advantages should buy enough time to build its client infrastructure and establish as a preferred approach in all digital means for companies and individuals.

However, with any cryptological investments, risks are ever present. One observable question is an increase in decentralized exchange such as bynance. These exchanges offer lower fees and more independence, which can complain about investors who are intervention of regulation or government in cryptocurrency Property. If these companies are to get additional popularity, it could seriously interfere with Coinbase customer base.

Is the tavern shopping, keep or sell?

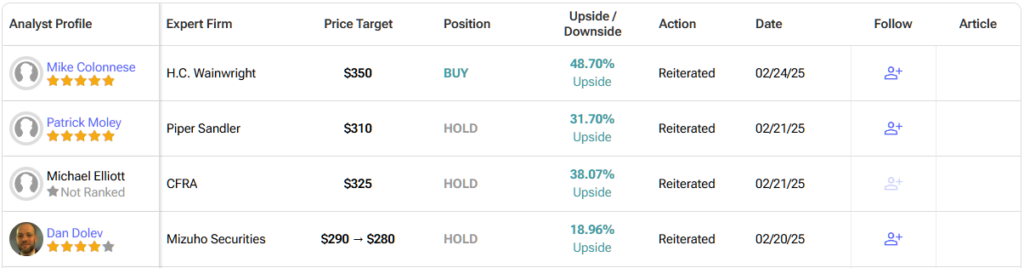

At Wall Street, the coin stock carries a moderate consensus ratio based on ten purchases, eleven holds, and zero sell grades in the last three months. Average coin price of $ 350.47 per share implies a huge 49% of the upside down potential in the next twelve months.

Promising future for Coin Adid Crypto volatility

The past year pointed out why investors were excited about cryptocurnancy and a tavern stock. With the American government, gradually establishing a clearer regulatory framework, there is potential for further growth. If the coinbase management continues to build user trust and strengthens its position as a leading cryptocurrency platform, the company can have a very successful future.

Using the crypto markets, it quickly exceeds the unregulated entity of critical doubt on regular conquest through critics until the day, coins could be the top addition of the investor’s portfolio, given the legitimized cryptic exposure. If investors are looking for a CRIPTO exposure, it is just worth doing it only through companies already monting this roman investment class.

https://blog.tipranks.com/wp-content/uploads/2025/02/shutterstock_1950877075-750×406.jpg

2025-02-24 17:28:00