Bitcoin 2024 performance as assets category

2024 returns and fluctuation

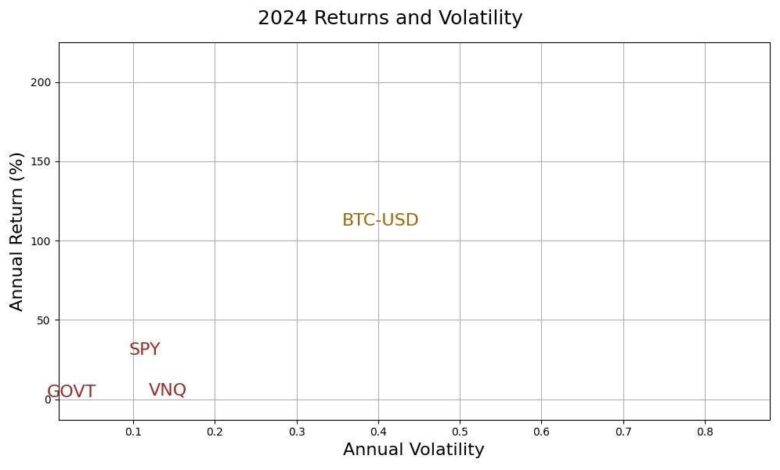

If Bitcoin is already a completely new asset category, we must compare its revenues for other asset categories. Bitcoin returned more than 113 % in 2024, and outperformed the categories of other major assets. Based on ETF agents, S&P 500 (SPY) returned by 23.7 %, Gold returned by 28.7 %, government bonds (GOVT) returned to -2.18 %, and real estate (VNQ) returned by -0.93 %. In terms of revenues, Bitcoin clearly defeated others.

But what about the risks? The returns are not complete. Another main dimension is the danger. Traditional financing measures the risk of volatility, that is, volatility in the share price. The annual fluctuation account is a transformation in daily fluctuations, and in itself is the standard deviation of the record returns of the original. Rational investors and risks will accept higher risks if it comes with larger returns.

As you can see, the bitcoin, arrows, gold and bonds are almost on the same linear path, which begins in the lower left corner of the scheme and ascends to the upper right corner. This is what economists call the “capital market line”, which sets the additional amount of the necessary return to compensate for additional risks. These four assets follow the same style: the greatest risk requires greater return. The only exception to the base is real estate, which was a bad year (high -risk returns). Last year was not the year in which real estate invests, as it could have done the same with government bonds, with much lower risk. Bitcoin, in this sense, does not break any rules. It simply offers a new option for investors looking for higher risks and higher returns.

The capital market line does not ask the initial question about “What is the correct amount for investors that investors should bear?” This is up to individual preferences. Historically, financial markets are always classified as shares as risky and safe. But with Bitcoin on the map, the stocks now look safe for Bitcoin. Another way to deliver this scheme is that the traditional measures of returns only calculate the nominal revenues, not real returns, that is, the returns after inflation. When determining the value of the value of the US dollar, government bonds and real estate will gain real negative returns.

Is fluctuation a problem?

In at least 2024, Bitcoin’s revenues exceeded the other assets that they are forcing an uncomfortable question: How important is the fluctuations really? And for whom? And when?

Again, the traditional assumption in the financial markets is that investors are alienated from the risks, and thus hate fluctuations at any cost. But the question remains: At any cost? If the investor has a long enough horizon, then the sacrifice of returning for volatility will be a mistake. It should not matter long -term volatility. He said differently, the fluctuations are only important in the short term because it may lead to the loss of capital if you are selling. In the long run, the real capital loss is the cost of an alternative opportunity: returns from not investing in the highest return assets. Therefore, volatility is an advantage, not a mistake, for the long -term investor.

Value investors such as Benjamin Graham, Warren Buffett, and Charles Brands were aware of the problem of using volatility to measure risk. Ultimately volatility does not distinguish between directional movements in the price. Assets with strong essentials record high fluctuations, but this may be less dangerous for the investor due to the low purchase price. This is true for companies that are less than their value as was the case for Bitcoin during the last bear market, when it decreased to less than $ 20,000.

There, of course, some warnings are in place. The new Trump administration has made clear a more convenient regulatory system towards cryptocurrencies, and bitcoin withdrawals in low years can be high, reaching 70 % historically. But in 2024, the year to bear the risk, and the return of bitcoin fixed that thesis.

https://imageio.forbes.com/specials-images/imageserve/67b87784cedac777761febce/0x0.jpg?format=jpg&height=900&width=1600&fit=bounds