BTC traders separate on a constant foster interest rate schedule

Author: Francisco Rodrigues (all times and different unless otherwise indicated)

CRIPTO traders are separated after the FOMC minutes. Fed wants to prevent rates continuously until inflation improves and discuss the pause or slowing down balance sheet.

However, the yield on the 10-year cash register fell and the dollar weakened. Cryptocurrencies are higher, with COINDESK 20 indexes 1.4% and bitcoin 1.2% for 24 hours. The winnings follow the remarks of the Czech Governor National Bank Ales Michl, which reiterated Bitcoin case as spare meansAnd President Donald Trump said he finished “War Joe Biden on Bitcoin and Cripto.”

Bitcoin merchants take access to waiting and see that demand for removing, lack of blocks of activity and influx of liquidity inflows Potential return to $ 86,000. It’s over $ 97,000 right now. Their attitude is visible not only in decay volatility, but also a significant decline in open interest.

Open interest in Bitcoin Futures contracts Fell below $ 60 billion Of the nearly 70 billion dollars in late January, they show that the information on coinfields. The fall comes in the middle of what seems to be an Memecoin detection As recent struggles, like Argentine’s debacle, moisturized enthusiasm.

“Currently, the market in the cold phase,” David Gogel, VP strategy and operation at the DIDKS Foundation, told COINDESK. “Bitcoin holds, but after it failed to break 105k in January, we saw the inflow of capital and speculative assets like Solana and Memoins.”

This hit is visible in an aggregate open interest in Futures contracts for salt, Solana Blocchain’s mother-in-law. Oi fell with about $ 6 billion in late last month to about $ 4.3 billion, according to the data from Thetie. Solana is one of the leading Memecoins networks.

“The market should remain muffled for wider macroed programs and geopolitical development that could cause moves,” Wintermute OTC Trader Jake About COINDESK said. These geopolitical development include growing tensions between Trumpmp and Ukrainian president voliodimir who led to a non-subtle public exchange.

The rejection of the lever and switching from risky plays suggests that the market can enter a new phase. What does it actually mean to see. Stay alert!

What to watch

- CRIPTO:

- Macro

- 20. February, 8:30: Statistics Canada makes data on the price of the manufacturer in January.

- PPI Mama Est. 0.8% vs. Prev. 0.2%

- PPI yoi prev. 4.1%

- 20. February, 8:30: The US Department of Labor releases that a weekly insurance request in a week closed for the week ended 15. February.

- Home job receivables. 215k vs. Prev. 213k

- 20. February 17:00: Fed Governor Adriana D. Kugler gives a speech entitled “navigation of inflation waves while driving to Phillips curves” in Washington. Linestreem Link.

- 20. February, 18:30: The Japanese Ministry of Interior and Communications report on the inflation of the price pricing prices in January.

- The basic inflation rate is EST. 3.1% vs. Prev. 3%

- IOI inflation rate. 3.6%

- The inflation rate of my prev. 0.6%

- 21. February, 9:45: S & P global releases February American reports Manager managers (Flash).

- Composite PMI prev. 52.7

- Production of PMI est. 51.5 vs. Prev. 51.2

- PMI est. 53 vs prev. 52.9

- 20. February, 8:30: Statistics Canada makes data on the price of the manufacturer in January.

- Earnings

Token events

- Voice and call management

- Unlock

- 21. February: Fast token (FTN) to unlock 4.66% of circulating supply worth $ 78.6 million.

- 28. February: Optimism (OP) to unlock 1.92% Circulating offer worth 34.23 million dollars.

- 1. March: SUI (SUI) to unlock 0.74% of the circulating bid worth $ 81.07 million.

- The token is launching

- 20. February: PI Network (PI) to be specified on MEXC, OCCS, Bitget, Gate.IO, Coinv, Digifinek and others.

Conferences:

COINDESK CONSENDENES TO DEPART Hong Kong 18. February and in Toronto 14. until 16 May. Use a daily code book and save 15% on the passage.

Token conversation

From Oliver Knight

- Pi, Gender token Pi Network, debuted to $ 1.70 and immediately rose to $ 2.00 before she lost 50% of her value in the next two hours.

- The network claims to have 60 million users. There are fewer than a million active wallets.

- Based on a Circulation report A picture of 6.3 billion, Pi currently has a $ 7.8 billion market.

- The space behind the PI network is a block that allows users to minine tokens on their smartphones. She caught significant attention to retail and pulled comparing with viral tokens from previous cycles like Safemon.

- Token owners face the risk of liquidity deficiency. The largest exchanges of the token is the OCCS, but 2% market depth – the amount of capital required to move the price by 2% in any direction – is between 33K and $ 60,000. This means that the row will say that $ 100,000 would significantly switch the market to present the volatile trading conditions.

Positioning derivatives

- BTC volatility on derivatives reached monthly low, decreases by an annual 36.09% to 28.43%.

- This contrary to the Eto, who considered the annual instability to increase from 49.43% to 74.72%, according to the data published by deribit.

- Approximately 1.5 billion of BTC and $ 1.5 billion options become to expire tomorrow, and almost $ 5 billion expires in weeks.

- The total open interest in all pairs of trade at the central retail exchange rise increased by 2.10% a day at $ 80.8 billion.

Market Crete:

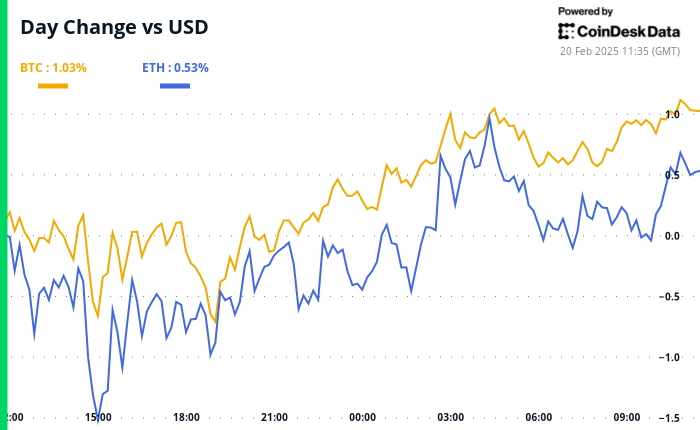

- BTC has risen 1.10% from 16:00 and Wednesday to $ 97,300.67 (24 hours: + 1.09%)

- ETH is 0.60% to $ 2,738,90 (24 hours: + 0.51%)

- COINDESK 20 increased by 1.72% to 3,250.68 (24 hours: + 1.67%)

- Ether CESR Composment Stki Stki is reduced 6 BPS to 2.99%

- BTC funding speed is at 0.0037% (4,0920% per annum) on binance

- DXI reduced 0.18% to 106.98

- Gold is 0.60% to $ 2,950.84 / Oz

- Silver is 1.52% to $ 33.19 / oz

- Nikkei 225 closed -1,24% at 38.678.04

- Hang seng is closed -1.60% on 22,576.98

- FTSE is 0.24% to 8,690.90

- EURO STOKK 50 increased by 0.62% to 5,464.99

- Djia closed Wednesday on the rise 0.16% to 44,627.59

- S & P 500 CLOSED + 0.24% AT 6.144.15

- NASDADAGE is closed + 0.07% at 20,056,25

- S & P / TSX Composite Index Closed Unchanged at 25,626.16

- S & P 40 Latin America is closed -1.35% on 2,463.68

- The American 10-year cash office rate was reduced 1 BPS to 4.53%

- E-mini S & P 500 futures reduced 0.2% to 6,150.50

- E-mini NASDAK-100 Fusurs reduced 0.22% to 22,200.75

- E-mini Dow Jones Industrial Average Future Index is 0.15% to 44,643

Bitcoin Statistics:

- BTC Domination: 61.10 (0.04%)

- Bitcoin: 0.02819 (0.28%)

- Hashrate (Weekly Average Movements): 831 EH / S

- HashPrice (Spot): $ 54.24

- Total fees: 5.127 BTC / $ 499,118

- CME Futures Open Interest: 172.360 BTC

- BTC price in gold: 32.8 oz

- BTC – Gold Market Cap: 9.32%

Technical analysis

- Bitcoin bounced from annually open to $ 93.3885, returning 100-day exponential movement of the average on the daytime.

- During the last three deep sales, the price formed more lower, indicating a strong interest of customers to current downs.

- However, short-term 20-day and 50-day EMAS at the daylight recently crossed the first time from 5. August, signaling the need for caution in close time.

Crypto Ekitees

- Microstrategi (MSTR): Closed on Wednesday at 318.67 USD (-4.58%), on the rise of $ 325.08 to $ 325.08 in the pre-market

- Global Coinbase Global: CLOSED $ 258.67 (-2.25%), grew 1.76% to $ 263.22

- Galaxy Digital Holdings (GLXI): CLOSED TO C $ 25,32 (-3,76%)

- Mara Holdings (Mara): Closed from $ 15.78 (-1.68%), grew 1.33% from $ 15.99.

- Errorable platforms: Closed $ 11.56 (unchanged), increase 1.04% to $ 11.68

- Basic Scientific (Corz): CLOSED FOR $ 12.02 (-2.99%), increased by 1.41% to $ 12.19

- Cleanspark (CLSK): CLOSED to $ 9.89 (-1.88%), increased by 1.81% to $ 10.07

- Coins Valkirie Bitcoin Rudari ETF (VGMI): Closed in $ 22.78 (-0.26%), unchanged

- Semler Scientific (SMLR): Closed for $ 52.22 (+ 2.96%), increase 0.06% of $ 52.25

- EKODUS Movement (ECSOD): CLOSED 48.41 USD (+ 4.00%), unchanged

ETF Toks

Spot BTC ETFS:

- Daily net flow: – $ 64.1 million

- Cumulative net flows: 40.00 billion dollars

- Total BTC Holdings ~ 1.170 million.

Spot Eth Etfs

- Daily Net Flow: $ 19m

- Cumulative net flows: 3.18 billion dollars

- Total Eth Foundation ~ 3,795 million.

Source: Faarse investors

Flows overnight

Chart of the day

- Data on the month for Top Bridge Netflows through the network points out a strong capital inflow in the base network from the beginning of the month.

- The layer block had a net inflow of $ 314 million, more than twice as much as a second-placed arbitrum, which saw an inflow of $ 115 million.

- The inflows of Solani slowed in the middle of liquidity caused by multiple high profile celebrity Memecoin, it is launched during the previous month.

While you were sleeping

- Memecoin Fiasco scales 251 million dollars in investors’ wealth, research shows (COINDESK): Nansen’s in chain analysts say that 86% of people traded line token lost money, with a total loss of $ 251 million. The winners enjoyed the total profit of $ 180 million.

- HK for expansion, open the Virtual Property Market (Standard): At the consensus Hong Kong, the CEO of SFC Julia Leung announced the Aspire – 12-piece maps for correcting market imbalances, custody, detention of the token framework, trade and lending to margin.

- Mantra launches a program to start funds for actual assets with support for Google Cloud (COINDESK): Layer-1 Blocckain Mantra’s Rvaccelerator supports the beginning of work on tokening real property assets by providing mentoring, with technical support and clouds coming from Google.

- China is likely to reduce its reference policy rate next month (CNBC): The Central Bank of China held its key lending rates on Thursday, which encouraged expectations of policy mitigation in March.

- The Golden Diggers of the Bank of England Color with Trump Fried French (Bloomberg): speculation due to the upcoming American tariff forced the small boe team to pull gold bars from 12.5 kg as merchants exploiting the gaps between the London spot and the American Futures price.

- “Stagflation” fears haunting American markets despite the Trump Pro-Grow Program (Reuters): While investors are largely remained in American stocks, some are worrying that president’s new tariff measures could start prices and stifle economic growth.

In the Etro

https://cdn.sanity.io/images/s3y3vcno/production/31768a791105eabacf9982f3aebfc184cce1b9e7-700×430.png?auto=format

2025-02-20 15:00:00