Rally ether turns into a Crypto market chip with Bitcoin sliding into less than 96 thousand dollars | Currency News Financial and commercial news

Etharum (Ethereum)EthThe force showed during the weekend, which sparked the hopes of the investor in obtaining a break in its pale prices, only to predict a decrease at the market level.

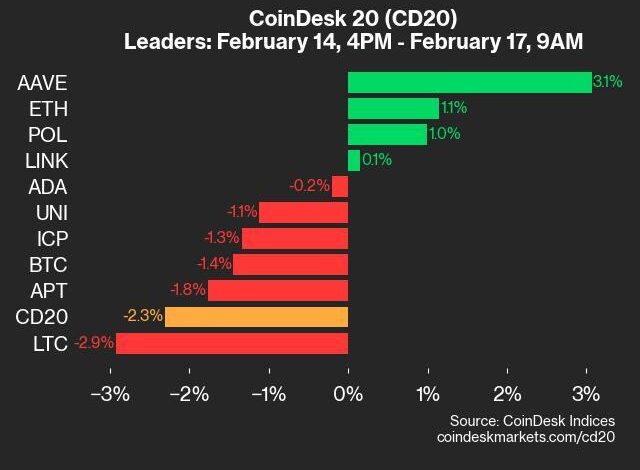

In a silent trading session due to the US holiday, it reaches 7 % up to the Monday session of $ 2,850, outperformed the rest of the encryption market. Next, gave up most of the gains, as it fell to $ 2730 with a wider market drop, with Bitcoin (BTCHe decreased to $ 95,500 from a little top from 97,000 dollars. However, ETH holds 2 % progress over the past 24 hours, while the Coindesk 20 and BTC index has been 2 % lower.

Traders were quick to point out past occasions, such as Late January and early FebruaryWhen a short ETH march foretells wider in encryption prices. After that, the ETHER increased by 10 % to 3400 dollars in three days at an ugly surrender event about the fears of the trade war, as BTC decreased by 13 % and ETH 35 % to nearly 2000 dollars during a low -weekend.

The power of the ether occurred as the fiascos Al -Mudan Argentina On Solana and BNB Broken -based series -Sincerely, former Binance Cz CEO, who reveals his dog’s name-is on the distinctive symbols of the competing Layer-1 networks.

“The procedure that the last ETH goes beyond performance outperforms performance-it is more than catching up with the place where it should be,” Aran Hooker, CEO of Automation Automation platform, told Coindesk on TeleGram. “Some traders may have returned again to the Sol, but there is no clear shift in the direction or structural change. Any performance can be erased by the next main market step.”

Joel Kruger, a market expert in the LMAX group, was more optimistic, saying that price procedures may be a sign that he ends a multi -year chip against Bitcoin.

“There is evidence that ETH is possible to finally put on a large bottom against Bitcoin after landing since 2021,” Krager said in the market note on Monday. “We think it will be important to closely monitor the highest monthly level in the Ethbtc ratio, with a return to a return to encouraging reflexive expectations.”

Coinglass data shows that the interest of encryption traders on the ETH rose on Monday for BTC. The open interest of ETH futures increased by 12 % to 9.27 million contracts (at a value of about $ 2.6 billion) on all stock exchanges over the past 24 hours, led by Binance and Gate.io external markets while BTC Futures grown only 1 % open interest.

This story was originally appeared on Coindsk

https://cdn.sanity.io/images/s3y3vcno/production/a2f379a97994e45d3d71e7a72d598db326488212-640×480.jpg