News and analysis on encrypted currencies, Blockchain and decentralized financing

According to the latest news, it was reported that he sold Bitcoin to the Bitcoin series and transferred the entire customization to ETF products.

A supporter of the stocks is justified to the flow applied to the bitcoin itself by explaining that institutional seizure allows him not to manage private keys and sleep more in peace, although he loses a component of decentralization.

Let’s go deep into the news below.

Encryption news

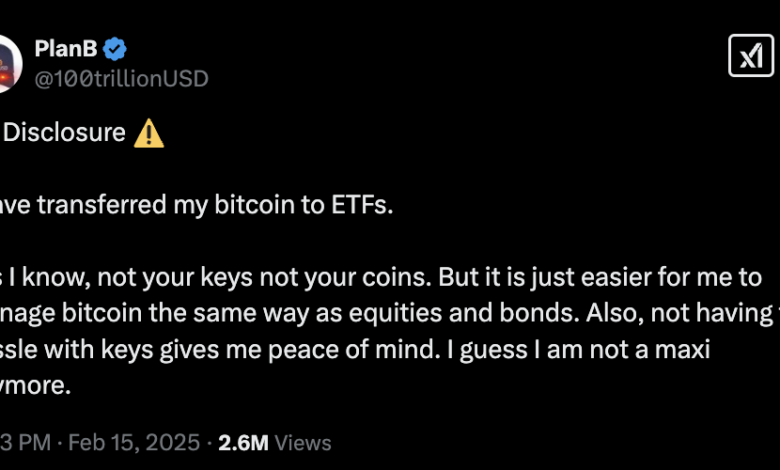

The famous Planb encryption analyst has recently announced that he had completely transferred Bitcoin from Self -friction To discover the exchange boxes (ETFS). In a post at X on February 15, he made the general news by telling his followers two million It is no longer the maximum bitcoinDespite his renewed support for digital assets. In general, “Maxis” BTC contract through programs or Devices Self -friction solutions and do not agree to other forms of reservation that include third -party entities.

Investment funds circulating funds on Bitcoin are financial tools that carry bitcoin directly as a basic asset, which entrusts the incubation of assets to financial institutions, such as deposit banks or specialized nursery companies. This allows investors to be exposed to bitcoin price without the need for direct management Special keys And with greater protection from organizational bodies.

This decision Planb It represents a major change in its management strategy Encryption investments. The analyst explained that by doing this, he will be able to deal with his bitcoin positions similarly to traditional assets, eliminating the complexity of the administration on the chain. The self -body already has the responsibility to maintain these keys in safe from InfiltratorsAnd thieves, and other malicious actors.

Plaanb also stated that in its specific condition, he has a tax residence in the Netherlands, the sale of Bitcoin for Fiat is not subject Taxes. Instead, in his country, there is a tax known as the wealth tax that requires paying about 2 % of the net taxpayer wealth every year.

More comfort at the expense of decentralization and management costs

The PLANB choice to switch to its ETF management for its Bitcoin definitely provides more comfort, but at the same time it means a smaller component of it Decentralization.

On the one hand, asset managers such as asset managers such The largest security, liquidity and organizational complianceReducing the risks associated with the loss of special keys or Electronic attacks. On the other hand, it means that these coins are no longer in the Planb possession, which reflects “Not your keys, not your currencies” philosophy.

Moreover, it should be considered that circulating investment funds are not completely free, but they have an annual management cost known as “”TaleBlackrock, for example, imposes a fee of 0.25 % on the assets deposited within Ibit project. These costs, when summarizing each year with the complex interest base, ends up spending a large part of the capital in the long run.

In addition to all this, with the accumulation of asset managers large amounts of bitcoin in record time, There is an excessive risk of network centralization. Keep in mind that from today, about 114.4 billion dollars, equivalent to 5.94 % of the maximum of the entire Bitcoin market, at the hands of the ETF management. If this number continues to rise more in the coming years, there will be a risk of a dangerous concentration of bitcoin control in the hands of some financial entities, against the principle of decentralization on which the protocol is based.

Plaanb received mixed notes from his followers after announcing X. Some support the choice of the analyst, on the pretext that securing the assets of the individual outside the chain becomes necessary when dealing with large sums in Bitcoin. Others criticized him harshly, saying that cold storage is still the best solution today to really own one encryption assets.

One thing is certain: Satoshi The bitcoin that the central institutions will be kept, and it will certainly not support the Planb step.

Bitcoin Investment Funds: 50 billion dollars in 2025

Since the beginning of the year, the Bitcoin Spot investment funds have been suffering from a strong force flow From capital, which indicates an increasing interest in institutional investors and retail investors. According to Hogan, the chief investment official in Bitwise, The year 2025 can be record for these financial tools, as the flows may exceed $ 50 billion. Indeed in January 2025, Spot Bitcoin Etfs raised $ 4.94 billion, which, on an annual basis, will offer a total of about $ 59 billion, greatly exceeding initial expectations.

Thus, the move by Planb is part of the context The adoption of the increasing institutional institutions and interest in the investment funds circulated in Bitcoin. Despite criticism, the increase in flows indicates the investment funds circulating in Bitcoin that the original acquires more and more legitimacy Among the institutional investors, strengthening its position in the global financial scene.

ETFS has become one of the main ways to reach Bitcoin without the complications of self -body, eliminating the friction that the special key management involves directly.

At the time of writing this report, the Bitcoin US investment funds are of $ 112.4 billion, and they decreased a little from the end of January. Blackrock Asset Manager with more than $ 57 billion in investments, followed by Fidelity, Grayscale and Ark Invest. Since they were included on the Wall Street organized stock exchanges, these traded investment funds have recorded a cumulative net flow of about $ 40 billion.

https://lh7-rt.googleusercontent.com/docsz/AD_4nXfbrSpEacCQQwEQI6nh1GHrIRYtT24-fzZ5c0pl1P9dEHr8KNQ4PckNtmRAkKSwchdGO1aZyEZHylpWetNWRIorCRhAF3ys7wGePUHFt6zPD5ddcC5bYqqo-P43HR1UTgrtgefR?key=nora3r0jz3JbuG1bHFxMTYGv