Litecoin, Jito and Bittensor set up two-digit sets, what to expect

Litecoin, Jito and Bittessor add between 17% and 22% to their values in the last seven days, according to COINGECKO data. Bitcoin Resistance and Market Recovery in the Cripto have a trip for gains in Altcoin.

Litecoin, Jito and Bittessor extend the sets on Friday

Litecoin (LTC), Jito (JTO) and BittenSor (Tao) added to its value on Friday after seven days of two-digit price sets. Bitcoin forklifts (LTC), Token base (JTO) and AI token (Tao) surpassed most Altcoin, ranking in the first 100 crypturations by market capitalization.

While Bitcoin still shows resistance to the face with hot American CPI, trump tariff announcement and other macroeconomic movements, Allcoyni recover from the correction next to the largest cryptocurlenza.

The LTC gained 2.53%, and JTO and Tao added 5.68% and 2.98% to their value per day, according to Tradingview.

Chain and technical analysis

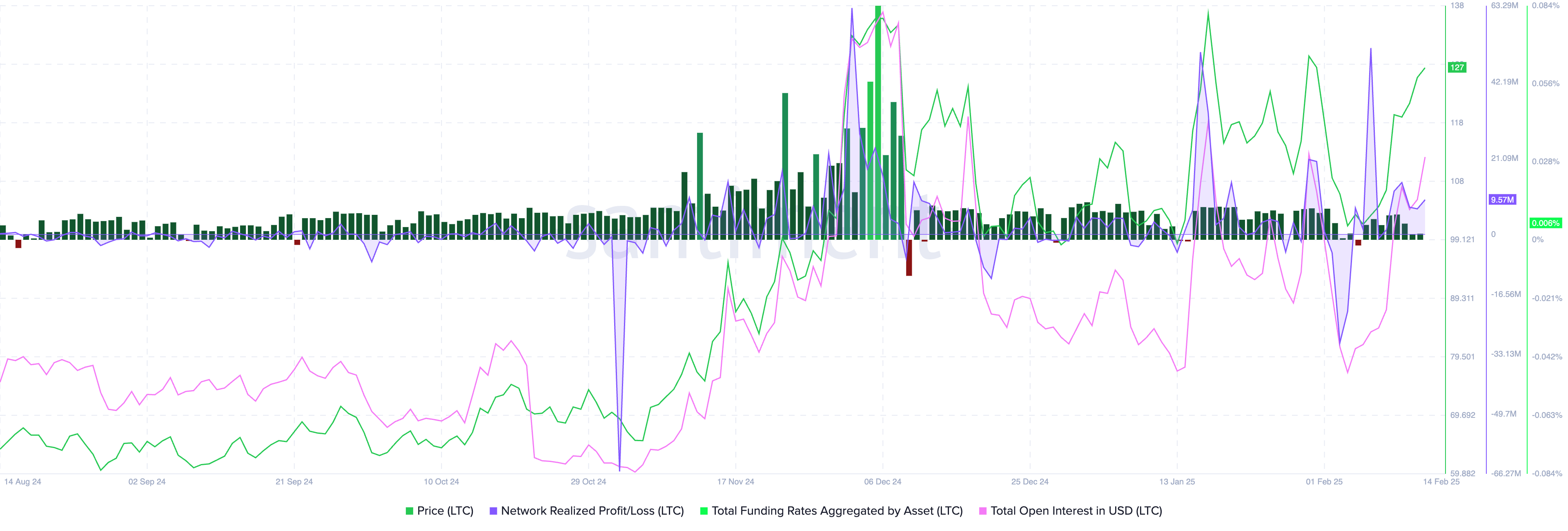

Santimental data show that in the past week, the interest in USD in Litecoin continuously climbed to the highest level on Friday, at 416.87 million dollars. The network realized profit / loss of metrics used to determine the net realized profit / loss of all the tokens moving to the chain at a given day shows a small producing the merchant.

The exchange rate on exchanges is still positive, as observed in the chart below.

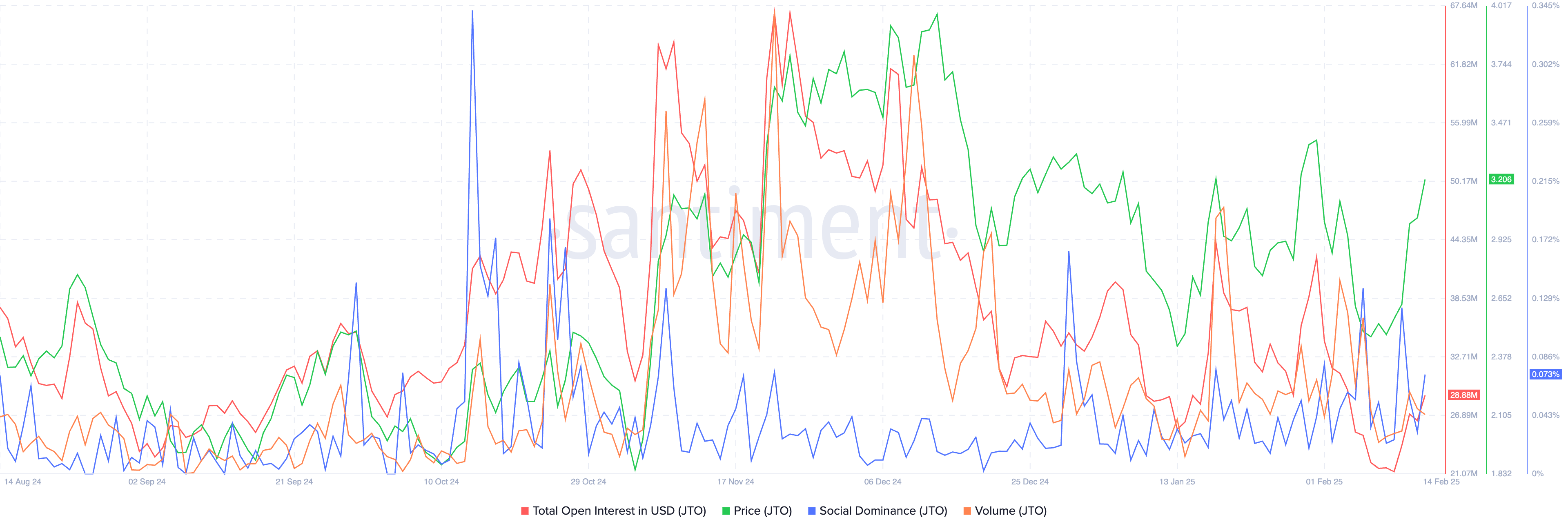

The overall open interest in Jito climbed, similar to LiteCoin, this week. There is a spike in social dominance, which means that the token became more relevant among traders and market participants. The volume of trade climbed and a sales-based token based in response to demand from institutional and retail retailers.

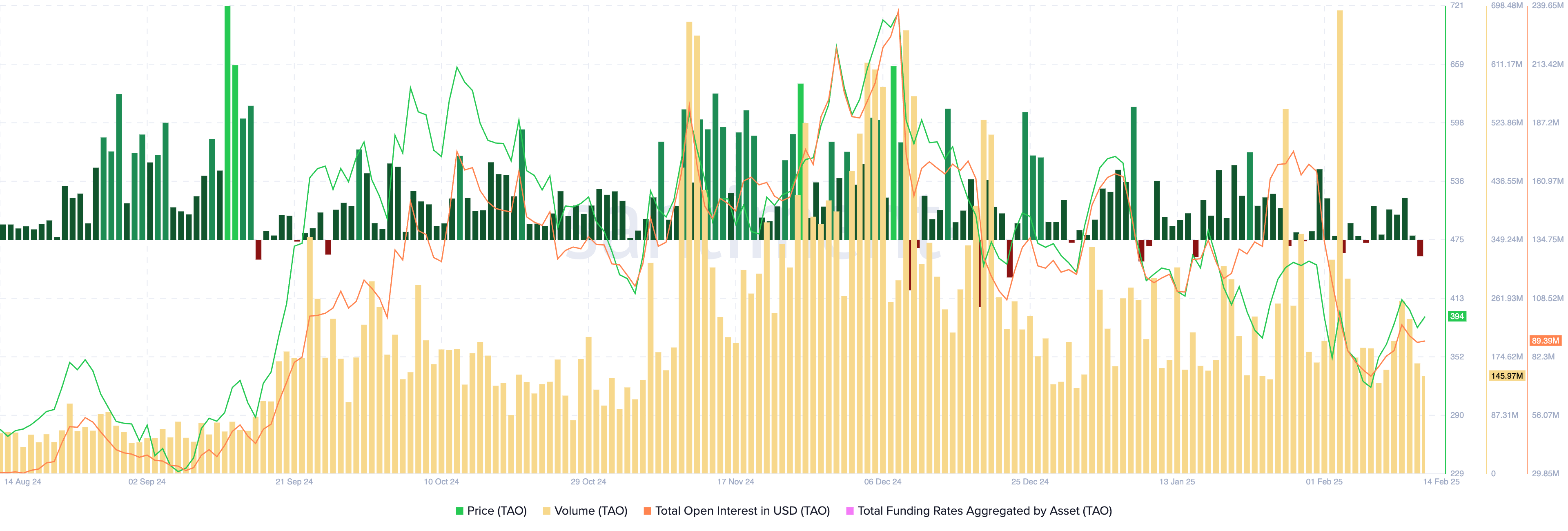

The bittensor data displays the volume that is kept stable, at an average level, with several positive spikes in the last week. The overall open interest recorded a spike 11. February, as seen in the Santiment Tablespoon below. Data on the rates of funds today show a negative spike, which means that traders must keep their eyes peeled on how derivatives traders on Friday, on Friday.

Litecoin could extend the winnings for almost 10% next week, trying to re-test the tip of 2025. Year in the amount of $ 141.22, as observed in the LTC / USDT daily price. Two climbers, RSI and MACD, support support in LiteCoin.

RSI reads 62 and hair is up, the MACD flashes green histogram bars above the neutral line, which means that there is a basic positive trend in the LTC price trend.

Litecoin It can find support in the fair values (FVG) between $ 109.18 and $ 117.81, in case of correction.

JTO Solana MTO could test resistance to R1, 16. December 16 to $ 3,841. The following key resistance is high and R2 to $ 4,340.

The long-term price of JTO is 2024. Years of $ 5,330, observed at JTO / USDT daily time frame. RSI and MACD support further token gain.

JTO could find support in FVG between $ 2.694 and $ 2,920 if Altcoin price is dropped.

Tao could be expensive almost 13% to test resistance at the upper limit of an unbalanced zone on the daily price chart, to $ 445.60. Tao could find support to $ 341.50, the level of support that has maintained stable for several weeks.

RSI is obliquely and MACD flashes green rods of histograms above the neutral line. There is a basic positive momentum in the Tao Trend price price at the daytime.

Market drivers in LTC, JTO and Tao

The elderly ETF Analyst for Bloomberg, Eric Balchunas, tweeted about the chance of Litekoin ETF approval. Balchunas says Litecoin leads the probability of ETF approval, with 90% chance.

Litecoin follows him to Solana. Balchunas explains that experts calculated chances only for “33 acts of Ibit-Eskue Flyings”. Balchunas believes that the products of futures or Chaimman-subsidiaries Clap 40 and the law could receive approval.

The ETF Hype is a key market driver for Litecoin this week.

The US CRIPTO Working Group in America and CRPO commissions have acted meetings with projects such as JITO laboratories, encouraging the disappearance of positive development in the Protocol. This arose as a key market driver for JTO price this week.

In the case of a Bittensor, Dynamic Tao, an update as important as Etherem’s Connection was conducted on Thursday. Intication of updates Drove Tao prices more about all week, and recent gains are probably an extension of rally.

Dynamic Tao, in question, the update will be implemented within a year, unlike the deadlines for connecting.

Griscale, one of the largest Krypto managers, tweeted the upgrade, its significance and influence on the Cripto and Tao Ecosystem.

Derivative data analysis

LiteCoin derivatives data from Koigulas show almost 12% increase in open interest or value of open contracts on derivatives in LTC in the last 24 hours. OI climbed to $ 719 million. The long / short ratio is above 1, which means that the derivative traders helped on Litekoya from Friday.

Oi in Jto is close to average of 2025. years to $ 35.06 million. OI climbed in the last three days, a larger positive spike is correlated with the anticipation of winnings in JTO price, in accordance with data on coinglas.

Tao records the decline in the amount of trading of derivatives with an increase in OI. The long / short ratio for a 24-hour time frame filed a little under 1, that is, therefore, are probably a bear dealers in Tao.

Through the exchange of derivatives, binance and the OCCS, the ratio is above 1. Merchants must hold their eyes peeled for switching Tao The price trend.

Detection: This article does not represent investment advice. The content and materials presented on this page are only only for educational purposes.

https://crypto.news/app/uploads/2024/02/crypto-news-Litecoin-option02.webp

2025-02-15 01:15:00