BTC Eyes PPI for CPI guidelines to make a federal backup rate

Written by James Van Stin (all times and others unless otherwise mentioned)

On Wednesday, unexpectedly Consumer hypertrophy increased (CPI) Numbers, all eyes are now turning into a production price report due at 8:30 am

Analysts expect the product price index on an annual basis to reach 3.2 %, that is, less than 3.3 % in December, with a month reading at 0.3 %, an increase of 0.2 %. Core PPI, which comes out of the prices of flying food and energy, is expected to appear primary inflationary pressure, which accelerates to 0.3 % of 0 % in December. As of January of last year, it is seen as falling to 3.3 %.

The most hot data is still expected to refer to monetary policy significantly, which may be delayed or even getting rid of cuts in the federal reserve category prices this year, against President Trump’s desires. The federal reserve is likely to be the most dominant restriction of risk assets. On the other hand, the most enlarged inflation data can weaken the dollar dome and decrease the treasury revenue with the help of strengthening the risk parts.

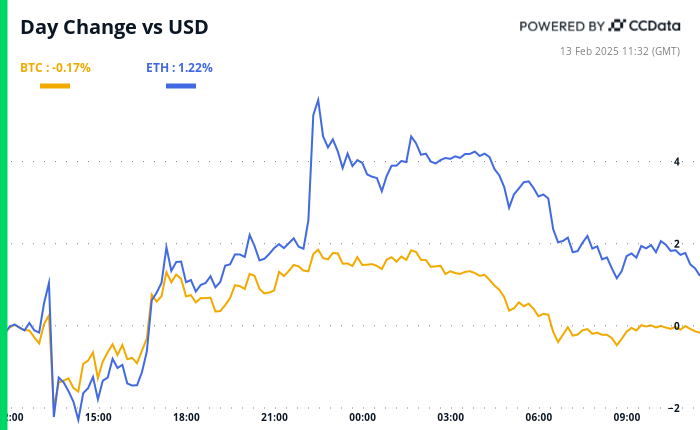

After the CPI data markets were volatile.

Treasury revenue increased to 4.6 % before declining slightly. The DXY index reflected this movement, rising to 108.5 before declining to less than 108.

Despite the initial sale, the pioneer The chapters of the assets are recoveredWith Bitcoin (BTCAmerican stocks and gold finish the session in green.

Also on the agenda, Coinbase (Coin) is about the profits of the fourth quarter after the market is closed. the next Strong RobinHood ResultsHigh expectations, and a positive report can provide a batch of encrypted currency market. Stay on alert!

What do you see?

- Checks:

- Macro

- February 13, 8:30 AM: The US Bls Statistics Office (BLS) launches the product price index (PPI) in January.

- The basic ppi mom 0.3 % against the previous. 0 %

- Basic ppi yoy estt. 3.3 % against the previous. 3.5 %

- PPI mom EST. 0.3 % against the previous. 0.2 %

- PPI yoy prev. 3.3 %

- February 13, 8:30 am: The US Department of Labor launches the weekly request for unemployment insurance for the week ending February 8.

- Initial unemployment allegations. 215K against the previous. 219k

- February 14, 8:30 am: The American Statistical Office launches retail sales data in January.

- Retail sales Mom Est. -0.1 % against the previous. 0.4 %

- Yoy Prev. 3.9 %

- February 13, 8:30 AM: The US Bls Statistics Office (BLS) launches the product price index (PPI) in January.

- Profits

Symbolic events

- Voices of governance and calls

- Dow curve votes on Increase the 3Pool amplification coefficient To 8000 more than 30 days and raising the official to 100 %. To improve liquidity, as part of the experiment, 3Pool will have higher fees while strategic reserves provide fewer fees.

- AAVE DAO discusses Using GHO as a gas code Through different networks. The frame suggests using the ecclesiastical network bridge to Mint GHO directly as a gas code.

- to open

- February 14: Sand Fund (Sand) to cancel 8.4 % insurance of $ 80.5 million.

- February 16: Irbia (ARB) to open 2.13 % of the trading offer of $ 45.1 million.

- February 16: Avalanche (Avax) to unlock 0.4 % of the trading offer of $ 42.8 million.

- February 21: The Fast Fast code (FTN) to open 4.66 % of the $ 79 million trading offer.

- February 28: Optimism (OP) to open 2.32 % of the trading offer of $ 34.8 million.

- Launching the distinctive symbol

- February 13: ETHEREUMPOW (ETHW) and MATAC are no longer supported in Deribit.

- February 13: The story (IP) to be included on the Bybit, Bitrue, Bitget, Mexc, Kucoin and OKX, among others.

- February 14: Penguins (Penguins) Listed in CoinbaseAccording to joint participation by the Pudgy Penguins account.

Conferences:

Coindsk consensus in occurrence Hong Kong on February 18-20 In Toronto from 14 to 16 May. Use today’s code and save 15 % on passes.

Locate the location of the derivatives

- Funding rates in permanent futures related to SOL, TRS, Tron and DOT remain negative, indicating a bias of short savings and data from Coinglass and VELO data.

- Annual financing rates in BTC and ETH are near 5 %.

- Most of the major coins, with the exception of BNB, have witnessed that Deltas is the negative that was adjusted in the cumulative size, a sign of net selling pressure, which raises a question mark on the sustainability of restoring consumer price indicators after the United States.

- Imagine BTC and ETH are positive in all fields, which reflects the bull’s prejudice.

- However, the flows were kept, with some demand for the upper strike calls in the upper strike, according to data sources, Deribit and Paradigm.

Market movements:

- BTC decreased by 1.53 % from 4 pm East to 96,206.67 dollars (24 hours: -0.02 %)

- ETH 0.23 % decreased at 2,677.69 dollars (24 hours: +1.79 %)

- Coindesk 20 decreased by 0.71 % to 3.201.06 (24 hours: +0.66 %)

- The ETHER CESR 5 -bit compound rate per second decreased to 3.05 %

- BTC financing is 0.0005 % (0.5606 % annually) on Binance

- DXY decreased 0.34 % in 107.58

- Gold rises by 1.26 % at $ 2945.7/ounces

- Silver rises 0.49 % to $ 32.85/ounces

- Close Nikkei 225 1.28 % in 39,461.47

- Hang Seng -0.20 % closed at 21,814.37

- FTSE fell 0.74 % in 8,742.63

- EURO Stoxx 50 rises by 1.23 % to 5,471.99

- Djia closed on Wednesday -0.50 % in 44,368.56

- S & P 500 closed -0.24 % in 6,051.97

- Nasdak closed 0.03 % at 19649.95

- Closed S&P F/TSX Complex -0.27 % in 25,563.1

- S & P 40 Latin America closed -0.93 % in 2,421.78

- The ministry of the Ministry of Treasury in the United States decreased for 10 years by 2 points per second at 4.61 %

- E-MINI S&P did not change in 6,073

- E-MINI NASDAQ-100 futures increased by 0.17 % at 21,842.75

- E-MINI Dow Jones Industrial Maled Indust Huster has not changed at 44,480

Bitcoin Statistics:

- BTC dominance: 60.91 (-0.14 %)

- ETHEREUM ratio to Bitcoin: 0.02784 (-0.50)

- Hashrate (Seven Day Average): 802 EH/S

- Hashprice (Stain): $ 53.2

- Total fees: 4.63 BTC / 446,657 dollars

- Cme Futures Open benefit: 166,680 BTC

- BTC at gold price: 33.1 ounces

- BTC Vs Gold Market Cap: 9.40 Oid

Technical analysis

- Since January 3, Bitcoin has been less than a 50 -day simple moving average (SMA).

- It now seems that the price has also decreased under the Ichimoku cloud, indicating a potential transformation of momentum.

- This twin breakdown can encourage bears. Immediate support is seen about $ 90,000.

Encryption

- Microstrategy (MSTR): closed on Wednesday at 326.82 dollars (+2.3 %), a decrease of 0.56 % to $ 325 in the market before the market.

- Coinbase Global (COIN): Closed at $ 274.90 (+3 %), an increase of 3.24 % at $ 283.8 in pre -market.

- Galaxy Digital Holdings (GLXY): Closed at $ 26.87 Canadian dollars (+1.24 %)

- Mara Holdings (MARA): Closed at $ 16.24 (+1.37 %), a decrease of 0.55 % to $ 16.16 in pre -market.

- Riot platforms (RIOT): closed at $ 11.16 (+0.18 %), a decrease of 0.54 % to $ 11.10 in the market before the market.

- Core Scientific (Corz): Closed at $ 12.09 (-1.39 %), unchanged in pre-market.

- Cleanspark (CLSK): Closed at $ 10.52 (+2.33 %), a decrease of 0.67 % to $ 10.45 on the market before the market.

- Coinshares Valkyrie Bitcoin Miners Etf (WGMI): Closed at $ 22.73 (+1.75 %), unchanged before the market.

- Semler Scientific (SMLR): Closed at $ 47.69 (+1.51 %), unchanged in the market before the market.

- Exit (exit) movement: closed at $ 48.85 (-0.63 %), an increase of 2.48 % at $ 50.06 in the market before the market.

Etf flows

BTC Etfs Stain:

- Daily net flow: -251 million dollars

- Cutting net flow: 40.21 billion dollars

- Total BTC Holdings ~ 1.174 million.

ETH ETFS spot

- Daily net flow: -40.9 million dollars

- Cutting net flow: $ 3.13 billion

- Total Eth Holdings ~ 3.788 million.

source: Farside investors

It flows overnight

Today’s scheme

- Daily trading volumes on pies -based decentralized stock exchanges have risen to the highest level since early December.

- Cake Token is partially renewed to the highest level in two months at $ 3.4.

While you sleep

In the ether

https://cdn.sanity.io/images/s3y3vcno/production/90a08f29668b5838c06c9bbec5d00eafa7836746-700×430.png?auto=format