Previously difficult Fed mood in BTC and ETH and liquidity pressure hits PENGU

By Omkar Godbole (All times are Eastern time unless otherwise noted)

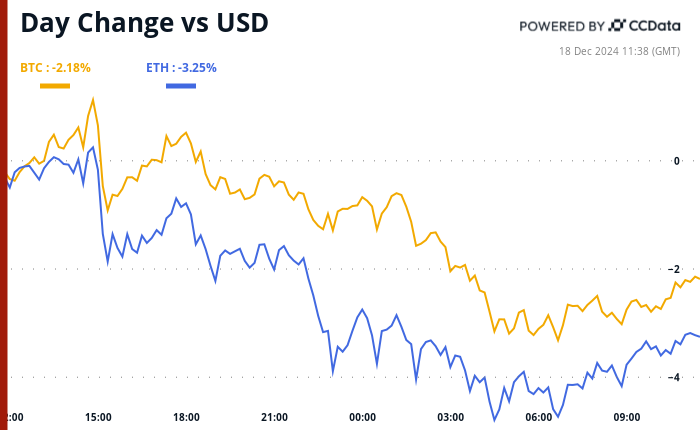

The cryptocurrency market is turning back on risk ahead of today’s Fed rate decision. Everyone is talking about the possibility of interest rates being cut again, which would stimulate risk appetite in the economy and financial markets.

Here’s the development: The central bank is expected to signal three interest rate cuts for 2025, not the four it predicted in September, as well as revising growth and inflation forecasts higher. It is not surprising then that Bitcoin and Ether are trading lower by approximately 2%, leading to larger losses in the small tokens. Among them, the Loose Penguins PENGU symbolwhich is down more than 50% since Tuesday’s airdrop.

Front call premiums have already taken hold in both BTC and ETH He took a hitWhich indicates a more cautious atmosphere in the market. Traditional markets are also taking into account hard cuts.

Now, experienced traders will tell you that when the forecast leans too heavily in one direction, there is always room for disappointment. To put it more simply, if interest rate expectations remain unchanged or Fed Chairman Jerome Powell eases concerns about flat inflation during his press conference while maintaining a data-driven approach, we could see a nice rally in risk assets – including cryptocurrencies.

VIRTUAL, the native coin of the AI and Virtuals Protocol platform, may shine in this case, after rising 11% in the Asian hours. “AI in crypto is shaping up to be a huge trend, especially in social trading, where data-driven insights and automation can empower traders,” said Neil Wynn, head of global business development at Kronos Research.

Leading on-chain platform HyperLiquid’s HYPE token is another candidate, trading 4% higher at press time. Social media gossip Refers to Limited exchange availability and holding of the token as a catalyst for the upside.

However, don’t let your guard down. Some observers say the pace of future interest rate cuts actually hinges on Friday’s core personal consumption expenditures data, the Fed’s preferred measure of inflation.

As Valentin Fournier, an analyst at BRN, said: “The Fed is set to announce a 25 basis point rate cut today – the last for the year. Future cuts may depend heavily on Friday’s core personal consumption expenditures report, which will be released on Friday”. It is expected to remain steady at 3.3% year-over-year, and any surprises with rising inflation could rattle markets, especially since Bitcoin is already feeling some downward pressure and lacks upward momentum.

In addition, a decline in Chinese government bond yields has piqued the interest of people at the Wall Street Journal Raising red flags About the world’s second-largest economy is facing a recession, a long period characterized by a sharp decline in economic growth and high unemployment rates.

These concerns could easily destabilize global markets, so now is definitely a good time to stay alert.

What to watch

- Encryption:

- Macro

- December 18, 2:00 PM: Federal Open Market Committee (FOMC) The bank issues its target range for the federal funds rate, which currently ranges between 4.50%-4.75%. the CME’s FedWatch tool This suggests interest rate traders have a 95.4% probability of a 25 basis point cut. The press conference begins at 2:30 p.m Live broadcast link.

- December 18, 10:00 PM: The Bank of Japan announces its decision Interest rate decision. Short-term interest rate estimates are 0.25% compared to the previous 0.25%.

- December 19, 7:00 AM: The Monetary Policy Committee (MPC) of the Bank of England (BoE) announces its decision. Interest rate decision. Bank Rate Corporation. 4.75% versus previous. 4.75%.

- December 19, 8:30 a.m.: The US Bureau of Economic Analysis (BEA) will release its report GDP for the third quarter (final).

- GDP growth rate on a quarterly basis, final estimates. 2.8% versus before. 3.0%.

- GDP Price Index Quarterly, Final Estimates. 1.9% versus before. 2.5%.

- December 20, 8:30 a.m.: The US Bureau of Economic Analysis releases its November report. Report personal income and expenses.

- Personal consumption expenditures (PCE) price index on an annual basis. 2.5% versus before. 2.3%.

- Core PCE price index on an annual basis. 2.9% versus before. 2.8%.

- December 24, 1:00 PM The Federal Reserve will release its November report H.6 Report (Cash Stock Measures).. Previous M2 money supply. $23.31 trillion.

Symbol events

- Governance votes and calls

- The Venus Protocol is officially expanding to Base. VIP-408 has passed the governance vote and users can access Venus on Base on December 19.

- It opens

- Metars Genesis will unlock 11.87% of MRS’s circulating supply, worth $11 million at current prices.

Conferences:

Symbolic discussion

Written by Shaurya Malwa

Early PENGU buyers are learning the risks of low liquidity the hard way.

The Pudgy Penguins ecosystem token debuted to massive fanfare on Tuesday. Its magic was its association with the already popular NFT group, which led to a buying frenzy in the hope of making a quick buck. But the token received the necessary liquidity at launch, which meant that the first enthusiastic buyers bought the token for a market value of $5 trillion.

Liquidity is the ability to buy or sell an asset without causing a significant change in price. For PENGU, the initial liquidity pools were shallow, meaning there were not enough buyers and sellers to keep the price stable.

One unlucky trader took a huge loss on an airdrop, turning $10,000 into less than $5 in seconds. Before the official launch, they exchanged 45 Solana tokens for PENGU but only received 78 tokens due to a glitch in Jupiter’s decentralized exchange. The trade was sent to a low-liquidity pool on Raydium, inflating the token’s price to an unrealistic market cap of $14 trillion. This incident was due to low liquidity, as even small trades can cause significant price fluctuations.

The PENGU token was created weeks before its launch, resulting in premature trading and huge losses for those who jumped in too early without checking the market value.

Determine the position of derivatives

- Positioning in Bitcoin futures is increasing, with open interest approaching a November high of 663.71K BTC. Meanwhile, ETH open interest reached a record high of over 339 thousand ETH.

- Funding rates in perpetual currencies linked to major currencies remain steady at around 10% per annum, and are in the middle of the -200% to 200% range, representing the extremes of bearish and bullish sentiment.

- BTC and ETH forward contracts are trading at a premium to calls, highlighting the demand for downside protection ahead of the Fed’s interest rate decision.

- The best BTC block trades include a bearish call spread that includes calls at strikes of $104,000 and $105,000 and a standalone long position of $95,000 expiring on January 3.

Market movements:

- Bitcoin fell 1.72% from 4pm EST on Tuesday to $104,593.98 (24 hours: -1.96%).

- ETH price fell 1.44% to $3,876.29 (24h: -2.89%)

- CoinDesk 20 fell 3.03% to 3830.21 (24h: +3.4%)

- The signature yield on Ether increased by 2 basis points to 3.18%.

- The BTC funding rate is 0.01% (10.95% per annum) on Binance

- The DXY index was unchanged at 106.90

- Gold rose 0.76% to $2,664.40 per ounce

- Silver rose 1.08% to $30.90 per ounce

- The Nikkei 225 index closed down 0.72% to 39,081.71 points.

- The Hang Seng Index closed 0.83% higher at 19,864.55

- The FTSE index rose 0.23% to 8,214.42 points

- The Euro Stoxx 50 index rose 0.32% to 4,958.35

- The Dow Jones Industrial Average closed Tuesday down 0.61% to 43,449.9 points

- The Standard & Poor’s 500 index closed down 0.39% at 6,050.61 points.

- Nasdaq closed down 0.32% at 20,109.06 points

- The S&P/TSX Composite Index closed 0.11% lower at 25,119.7

- The S&P 40 Latin America index closed up 0.16% to 2,280.58 points.

- US 10-year Treasury bonds were unchanged at 4.4%.

- E-mini S&P 500 futures rose 0.25% to 6,069.00.

- E-mini Nasdaq-100 futures rose 1.58% to 22,363.25.

- E-mini Dow Jones Industrial Average futures rose 0.2% to 43,563.00.

Bitcoin statistics:

- Bitcoin Dominance: 57.78% (24h: -0.33%)

- Ethereum to Bitcoin ratio: 0.037 (24h: +1.04%)

- Hash rate (seven-day moving average): 776 EH/s

- Retail price (spot): $63.4

- Total fees: $1.4 million / 12.7 BTC

- CME futures open interest: 212,635 BTC

- Bitcoin price in gold: 39.4 ounces

- BTC vs. Gold Market Cap: 11.22%

- Bitcoin held in OTC desk balances: 406,700 BTC

Basket performance

Technical analysis

- Bitcoin’s dominance rate has risen from 55% to nearly 58% in two weeks, reclaiming its year-to-date upward trend line.

- It’s a sign of investors’ renewed preference for Bitcoin over altcoins.

Crypto stocks

- MicroStrategy (MSTR): Closed Tuesday at $386.42 (-5.41%), up 0.45% at $388.15 pre-market.

- Coinbase Global (COIN): Closed at $311.64 (-1.16%), down 0.98% at $308.60 pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$28.67 (-3.01%).

- MARA Holdings (MARA): closed at $24.60 (+0.16%), down 1.5% at $24.23 pre-market open.

- Riot Platforms (RIOT): closed at $13.97 (-0.43%), down 1.36% at $13.78 pre-market open.

- Core Scientific (CORZ): Close at $16.03 (-3.2%), down 1.19% at $15.84 pre-market.

- CleanSpark (CLSK): Close at $12.36 (-0.96%), down 0.49% at $12.30 pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $29.04 (-1.89%), down 0.48% at $28.90 pre-market.

- Semler Scientific (SMLR): closed at $74.73 (+0.31%), up 2.97% at $76.93 pre-market.

ETF flows

Spot Bitcoin ETFs:

- Net daily flow: $493.9 million

- Cumulative net flows: $36.70 billion

- Total BTC holdings ~ 1.136 million.

ETH ETFs

- Net daily flow: $144.7 million

- Cumulative net flows: $2.46 billion

- Total ETH holdings ~ 3.530 million.

source: Persian investors

Night flows

Today’s chart

- The chart shows the explosive growth of the memecoin sub-sector, whose market capitalization has now exceeded $100 billion.

- It’s proof of how the allure of speculation and a successful social media strategy can drive investors to take risks.

While you were sleeping

- Bitcoin takes a breather after Doji candle in cautious risk mitigation ahead of Fed (CoinDesk): After Bitcoin hit a record high above $108,000 on Tuesday morning (ET), the cryptocurrency market shifted into a more risk-off mood ahead of the Federal Reserve’s expected 25 basis point interest rate cut later today.

- The dollar is stable against its peers as the Federal Reserve interest rate cut approaches (Reuters): The US dollar stabilized on Wednesday, with the DXY index retreating to 106.89 from recent highs, as markets await the Federal Reserve’s interest rate decision and 2025 outlook.

- Next, the head of banking affairs in the US Senate calls cryptocurrencies “the next miracle” in the world (CoinDesk): Incoming Senate Banking Chairman Tim Scott praised cryptocurrency innovations on Tuesday and called for speedy legislation, while incoming House Financial Services Chairman French Hill predicted bipartisan cryptocurrency laws could pass in 2025 with Senate support. .

- South Korea’s Yoon skips interrogation, increasing risk of arrest (Bloomberg): South Korean President Yoon Suk-yeol, who was impeached on Saturday, skipped an interrogation session scheduled for Wednesday morning by a joint investigation team, raising the risk of his arrest.

- The decline of the Brazilian currency threatens to worsen unless financial reforms are implemented (Financial Times): The Brazilian real hit a record low of 6.21 to the dollar on Tuesday, as rising debt and financial concerns under President Lula’s government led to calls for higher interest rates and credible reforms to stabilize the currency.

- Coinbase says it canceled wBTC because Justin Sun poses an ‘unacceptable risk’ (CoinDesk): Coinbase on Tuesday defended its decision to delist wBTC on December 19, citing risks associated with Justin Sun’s alleged involvement and rejecting BiT Global’s lawsuit claims of favoritism toward its competing assets.

In the ether

https://cdn.sanity.io/images/s3y3vcno/production/6ec273ec46cb50220ee353f4a9773bd63a802f20-700×430.png?auto=format