The whole thing is related to non -agricultural salary companies, where the BTC price ignores Eric Trump’s support

Written by omkar GodBole (at all times ET unless it is indicated otherwise)

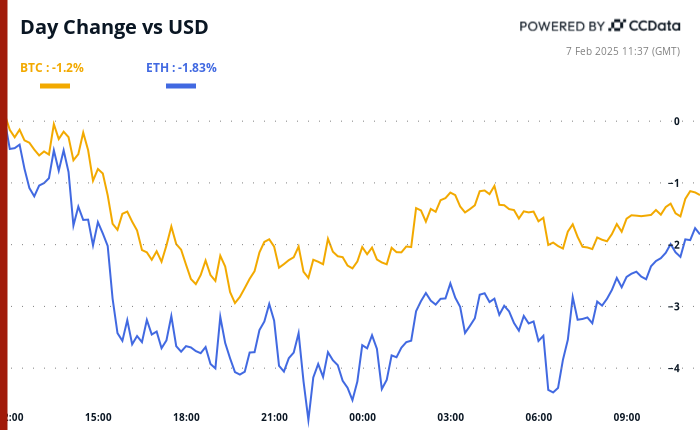

The encryption market remains without direction, as Bitcoin (BTC) suffers from $ 100,000 before the American jobs report. It is surprising that the prices have not yet crossed that threshold, especially after President Donald Trump, Eric, encouraged the family to invest in BTC in a publication on Thursday.

Usually, these approvals during the bull race lead to great gains. This was not achieved that the signs markets are no longer supported by speaking alone and Trump needs to walk. Early this week, the administration said it evaluates the BTC strategic reserve feasibility.

Another possibility is that caution before the salaries of unnamed in the upper direction mode are crowned. If this is the case, the outbreak may occur once the data comes out, especially if the number prints weaker than the ability, which is likely to lead the treasury and the dollar index lower.

The Crypto Newsletter Londoncryptoclub service recommends following up reviews in previous numbers. The founders of the news services said: “Bloomberg intelligence expects some great negative reviews that indicate that the labor market is not of the same strength in 2024 as it appeared for the first time, we still believe that the market (and the Federal Reserve application) are subject to prices that will need to come.” On x.

At the time of the press, the VOLMEX fluctuation index, which lasts for a day, reached 51 % annually, indicating that the daily swing is 2.6 %, or about 2600 dollars. In other words, the number can move the immediate price of $ 2600 in either direction. It is worth noting that some traders buy mode options, and prepare for possible negative fluctuations if the data is strong.

In other news, the “Bitcoin Strategic Reserves” bill Pass The House of Representatives in Utah and will now move to the Senate. Bloomberg analyst ETF James Sevart I mentioned The American SEC has recognized the Solana 19B-4 files from Grayscale. Fanak Propagate The price of $ 500 for Sol, more than twice its current value of about $ 180.

In addition, Fox Eleanor Terit correspondent subscriber Head of the Financial Services Committee in the United States of French Hill and the sub -committee for digital assets, Brian Steel, issued a draft discussion of the organization Stablecoin, which Suggest A two -year ban on stablecoins is only supported by self -issued digital assets and the treasury study results in its risks.

Finally, Bera Token from Brarachain, who first appeared yesterday, recorded a stunning permanent trading volume of $ 4.8 billion, at his price currently sitting at $ 7.60, a significant decrease from the peak of $ 14. Stay on alert!

What do you see?

- Checks:

- February 13: A gradual start kraken to cross out From Usdt, Pyusd, Eurt, Tusd, Ust Stablecoins for EEA customers. The process ends. 31.

- February 18, 10:00 am: FTX Digital Markets, the subsidiary of the Bahamas Islands in FTX, He will start paying creditors.

- Macro

- February 7 /

- Non -farm salaries in the east US time. 170K against the previous. 256k

- EST unemployment rate. 4.1 % against the previous. 4.1 %

- Feb 8, 8:30 pm: The National Bureau of Statistics (NBS) launches the Consumer Prices Index (CPI) in China.

- The previous mom’s inflation rate. 0 %

- The previous Yi inflation rate. 0.1 %

- PPI yoy prev. -2.3 %

- February 7 /

- Profits

- February 10: Canaan (He can), Before the market, -0.08

- February 11: Digital Cell Techniques (cell), After the market, -0.11 dollars

- February 11: Exit Movement (exit), After the market, $ 0.14 (2 ESTS.)

- February 12: Cotton 8 (hut), Before the market, $ 0.04

- February 12: Irene (Irene), Post -market, -0.01 dollars

- February 12 (TBA): Metaplanet (Tyo: 3350)

- February 12: Redit (RDDT), After the market, $ 0.25

- February 12: Robinhood Markets (Hood), after the market, $ 0.41

- February 13: Coinbase Global (currency), After the market, $ 1.61

Symbolic events

- Voices of governance and calls

- The osteoporosis is discussion Change to use the collected row fees in OSMO to burn 50 % of the collected fees.

- Dow’s threshold is discussion Create a Bond program to address liquidity challenges in Stablecoin.

- Dow heaven Voting On an executive suggestion to reduce savings rates, sweep more than 400,000 Days in Pauseproxy in the insulating excess and allocate 3 million Dai to finance integration enhancement, among other things.

- Dow is the distinguished discussion Eliminate the role of the protocol’s guardian on the concerns surrounding it to bypass previous democratic decisions and potential legal risks.

- February 7, 1 pm: race economics (race) to Hold Distinguished symbol owners give the distinctive symbol discussion, product road and partnership map.

- Feb 8, 1:08 pm: Dydx Foundation vote When the Subdao Subdao market salad is given DYDX operations on the market map and the sharing of revenue for that function in the right track to pass it.

- Feb 10, 10:30 AM: OKX to Hold Ama lists with the chief marketing employee Haider Rafeque and Product Marketing Chairman Matthew Osofisan.

- to open

- February 9: Movement (move) to open 2.17 % of the trading offer of $ 31.41 million.

- February 10: APTOS (APT) to open 1.97 % of $ 68.99 million in offer.

- February 12: Aethir (ATH) to open 10.21 % of the 2.72 million dollar offer.

- Launching the distinctive symbol

- February 7: Avalon Labs (AVL) to be included on bybit.

- February 13: ETHEREUMPOW (ETHW) and MATAC are no longer supported in Deribit.

Conferences

Coindsk consensus in occurrence Hong Kong on February 18-20 In Toronto from 14 to 16 May. Use today’s code and save 15 % on passes.

Distinguished symbol speech

Written by Shuria Malwa

- BNB series rackets are the gambling with a random TST icon after an educational video that showed its creation.

- TST, or Test Taken, was released, on the BNB series using the BEP-20 standard. It was not officially launched by Binance, but it is used in an educational video to create a code by the BNB team.

- The price increased after sharing the video by the Binance Changpeng Zhao on X because the users took the official Binance icon, although Zhao no longer has an official role in the company.

- Zhao delete it in the video later.

- TST has increased to the maximum market of about $ 40 million, shortly after the Zhao Publishing, reaching trading volumes of more than $ 90 million in Peak.

Locate the location of the derivatives

- Permanent financing rates for BERA are very negative, as it offers a strong bias to fill short jobs. Sol, BNB, SHIB and BCH also have negative rates.

- QCP Capital noticed that the demand for BTC puts 90 thousand dollars and 80 thousand dollars of strikes on February 28 in a sign of continuous negative concerns.

- Block flows with BTC calendar were characterized by prices of less than $ 120,000 by the end of April, but eventually exceeded $ 170,000 at the end of December. In addition, a long explicit period was offered at the expiration of $ 88,000 in February.

- ETH flows for a long time were marked by an expiration call on February 14 at the strike of $ 2800.

Market movements:

- BTC increased by 1.24 % from 4 pm East to 97,686.16 dollars (24 hours: -1.07 %)

- ETH rose 1.61 % at 2,757.18 dollars (24 hours: -1.75 %)

- Coindesk 20 increases by 1.99 % to 3,215.42 (24 hours: -1.83 %)

- The CESR 3 -bit vehicle survey rate decreased to 3.06 %

- BTC financing is 0.0052 % (5.72 % annual) on Binance

- DXY is 0.08 % in 107.78

- Gold rises 0.37 % at 2,866.78/ounces

- Silver rises 0.29 % to $ 32.26/ounces

- Nikkei 225 closed 0.72 % at 38,787.02

- Hang Seng closed by 1.15 % in 21,133.54

- FTSE fell 0.29 % in 8,703.92

- EURO Stoxx 50 decreased by 0.15 % at 5,348.71

- Djia closed -0.28 % to 44,747.63

- S & P 500 closed +0.36 % in 6,083.57

- Nasdak closed +0.51 % in 19,791.99

- S & P/TSX Bottom Expion -0.14 % at 25,534.49

- S & P 40 America America closed +1.87 % at 2,437.08

- The Treasury has not changed for 10 years at 4.44 %

- E-MINI S & P 500 has not changed in 6,104.00

- E-MINI NASDAQ-100 did not change in 21,855.75

- The E-MINI Dow Jones Industric index has not changed

Bitcoin Statistics:

- BTC dominance: 61.62 (-0.48 %)

- ETHEREUM ratio to Bitcoin: 0.02823 (1.40 %)

- Hashrate (Seven Day Average): 808 EH/S

- Hashprice (Stain): $ 57.2

- Total fees: 5.17 btc / 514,435 dollars

- CME FUTERES Open benefit: 163,140 BTC

- BTC at gold price: 33.7 ounces

- BTC market roof against Gold: 9.58 %

Technical analysis

- Bitcoin appears to cross below the Ichimoku cloud It is used by merchants to measure The power of momentum and the strength of the direction.

- The crosses are taken below the indicator to represent a decreased transformation in the direction.

Encryption

- Microstrategy (MSTR): closed on Thursday at $ 325.46 (-3.34 %), an increase of 0.63 % at $ 327.50 in the market before the market.

- Coinbase Global (COIN): Closed at $ 270.37 (-1.73 %), an increase of 0.75 % at $ 272.39 in pre-market.

- Galaxy Digital Holdings (GLXY): Closed at $ 27.07 Canadian dollars (-2.13 %)

- Mara Holdings (MARA): Closed at $ 16.80 (-1.35 %), an increase of 0.89 % at $ 16.95 on the market before the market.

- Riot platforms (RIOT): closed at $ 11.61 (-1.11 %), an increase of 0.69 % at 11.69 dollars on the market before the market.

- Core Scientific (Corz): Closed at $ 12.53 (-1.42 %), an increase of 0.32 % at $ 12.57 on the market before the market.

- Cleanspark (CLSK): Closed at $ 10.38 (+0.68 %), an increase of 6.84 % in 11.09 in the market before the market.

- Coinshares Valkyrie Bitcoin Miners Etf (WGMI): Closed at $ 22.76 (+1.34 %), a decrease of 0.06 % to $ 22.70 in the market before the market.

- Semler Scientific (SMLR): Closed at $ 49.92 (-3.61 %), an increase of 2.14 % at $ 50.99 in the market before the market.

- Exit (exit) movement: closed at $ 48.01 (-6.52 %), unchanged in pre-market.

Etf flows

BTC Etfs Stain:

- Daily net flow: -140.2 million dollars

- Cutting net flow: 40.53 billion dollars

- Total BTC Holdings ~ 1.174 million.

ETH ETFS spot

- Daily net flow: 10.7 million dollars

- Cutting net flow: 3.18 billion dollars

- Total Eth Holdings ~ 3.783 million.

source: Farside investors

It flows overnight

Today’s scheme

- The common market value of the two best stablecoins, USDT and USDC continues to grow and quickly decrease from $ 200 billion.

- The height of money is uncompromising to the money to the encryption market, which hints to upward horizons.

While you sleep

- Bitcoin in a Mire, Gold Eyes 6th Fociat Week from gains with job data looming (CoINDESK): BTC is struggling to find its feet amid a decrease in the activity of the Bitcoin network, American job data today will give some clues about what the Federal Reserve may do after that.

- Vanck says that Solana may reach $ 520 by 2025. (CoINDESK): The VANECK investment company will reach the price of $ 520 by the end of the year. The prediction depends on the increasing demand on smart nodes and expansion of money in the United States M2.

- Waller’s Fed says (Bloomberg): While delivering a speech in Washington, Federal Reserve Governor Christopher Waller expressed his support for Stablecoins as long as the appropriate “organizational bars” exist “to ensure that the money is present.”

- Memecoin Copycats begins concerns for investors (The Financial Times): According to FT analysis, because Donald Trump and his wife launched the official Mimikoin, more than 700 imitators of the official Solana portfolio were immersed, prompting investor warnings.

- The Central Bank in India is lowering corridors for the first time in nearly 5 years; Less restricted signals (Reuters): The Indian Reserve Bank (RBI) reduced the Ribo rate by 25 basis points while maintaining a neutral political position in an attempt to stimulate the slow economy amid low growth expectations.

- Look at India, Japan about “Alpha quality” amid uncertainty in the market, the investor says (CNBC): According to the alternative investment company Pag, it is difficult to find alpha in China now because of the faded economy and uncertainty about the impact of the trade war with the United States

In the ether

https://cdn.sanity.io/images/s3y3vcno/production/0e7c84ca4623112c8a5541545da0409b3139d637-700×430.png?auto=format