$ 7.25B in Bitcoin options set to expire, market ready for a great move

Bitcoin is preparing for a significant instability event, launched for 7.25 billion dollars that are set to expire.

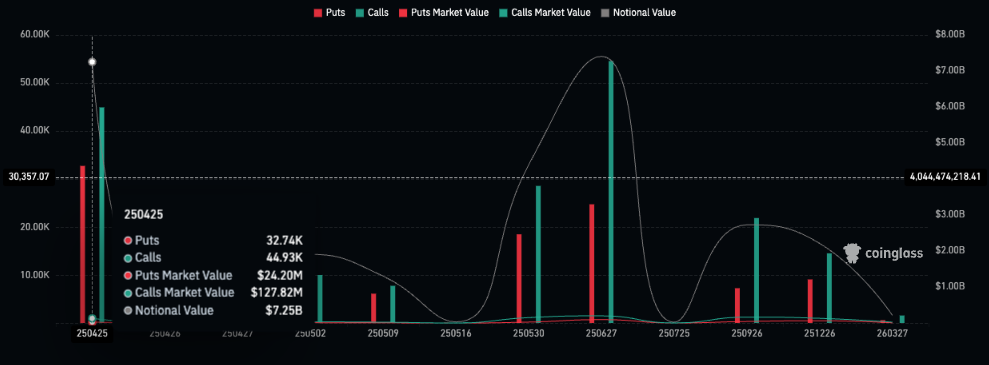

Bitcoin’s (BTC) The derivative market can soon become a catalyst for great moves for BTC. 25. April $ 7.25 billion In Bitcoin options, they must be expired, usually launch significant instability. However, the direction of this instability remains uncertain.

According to Marcin Kazmierczak, co-founder and COO Oracle Provider Redstone, Bitcoin showed significant resilience. Compared to traditional markets, the CRIPTO property declared relatively well with a recent macroeconomic uncertainty.

“Tomorrow it looks like especially spicy, which comes at a time when the market seems indecisive due to its next big move,” Kazmierczak said in the notebook that was sent cripto.news.

25. April, a total of 32,74K Position contracts and 44.93K Call contracts are set to highlight. The market value of these contracts signifies 24.20 million dollars for views and $ 127.82 million for calls. A significant gap between putting and calls, with calls outweighs approximately 5K, suggests that traders rely on the bakarian income.

Smart money is betting on volatility: Kazmierczak

Kazmierczak admits that options about stretching events that expired often contribute to significant market swings. If all contracts were performed, their total methynal value would be 7.25 billion dollars, a figure that could have a noticeable impact on the BTC price. For this reason, he believes that smart money is preparing for volatility.

Smart money is probably positioning for some dramatic swings, making it perfect for occasion and cautious investors to pay close attention, “Marcin Kazmierczak, Redstone.

At the same time, he emphasizes constant maturation of the CRIPTO ecosystem. This allows long-term investors with a chance to use volatility and provide more favorable input points.

“While we can face unstable about the expiration of options, the basic basis remain extremely strong, with quantities of stablecoin, adoption Bitcoin and real-world assets that have exceptional growth costs.”

Kazmierczak also noticed that the crypto market remained relatively stable compared to capital. In contrast, traditional markets faced observed turbulence, greatly due to fear they surrounded the influence of Donald Trump tariffs on major trading partners.

“It is worth noting that the crypto market showed surprising resilience compared to traditional markets, which rocked tariff concern – a sign that digital funds can establish their own market dynamics less associated with traditional financial turbulence.”

https://crypto.news/app/uploads/2024/10/crypto-news-Maximizing-returns-in-a-volatile-market-The-role-of-Bitcoin-yields-option01.webp

2025-04-24 22:52:00