3 reasons why AEV prices can exceed 200% this year

AAVE Referred week, Mirror performance Most Altcoin as tariff risks remained concern.

AAVE (Take) The token fell lower than $ 196.4, the lowest level of 25. November and currently 50% below its highest level this year.

The token has several catalysts that can push it in its high amount of 666 dollars, an increase for 170% from the current level.

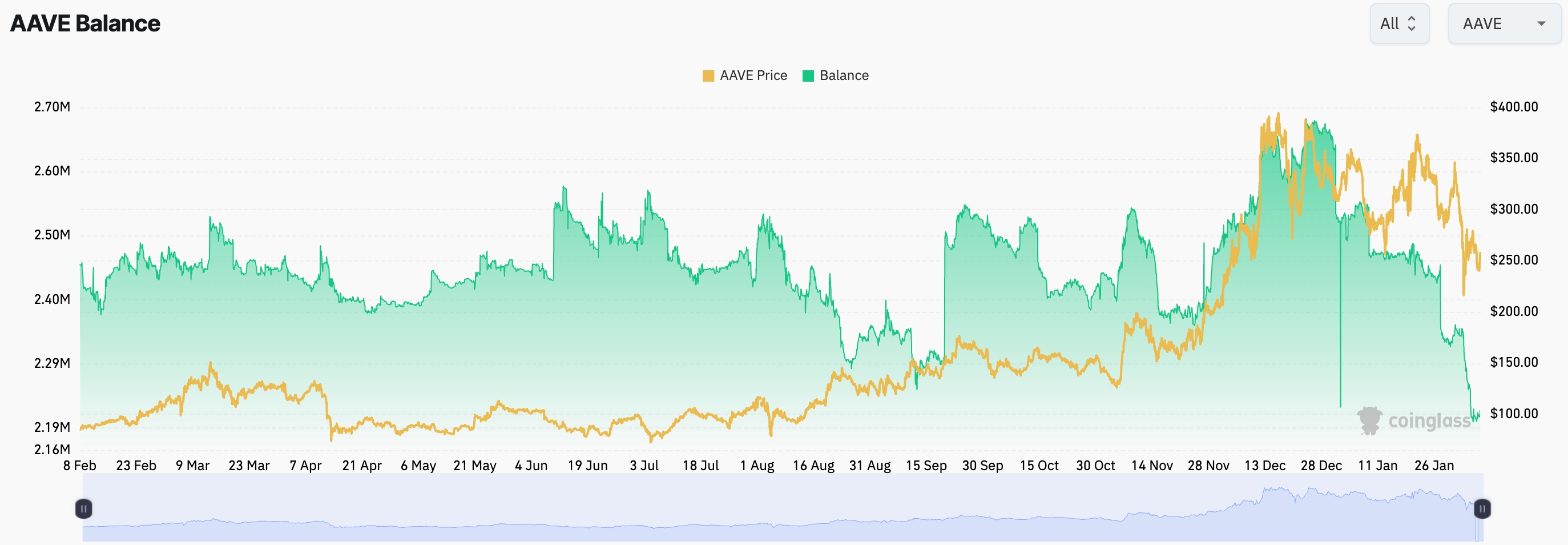

First, there are signs of increased accumulation by investors. Data on Koigulas show that AAVE balance of exchanges crashed at the lowest level in years. These balance sheets moved to 2.2 million on Friday, and up to 14,667 million in December.

A significant decline in balance sheet suggests that investors hold their tokens, not selling, which is a positive indicator. In contrast, the balance of growing often indicate the pressure sales, because investors move their farm from self-vision to sell.

Second, AAVE is still the largest protocol of borrowing and lending in the crypt industry, with about 20 billion dollars of property. It is also one of the most profitable because they skipped annually to over $ 721 million. Tokenterminal The data show that this year brought over $ 103 million.

It is significant that AAVE has successfully processed over the 201 million dollars of liquidation on Monday, because the prices of cryptocurnancy have fallen. Despite significant liquidations, no bad debt collected AAVE, and the total bad debt fell by 2.7%.

AAVE network is also expanding. More than 440 million USD Stablecoin was deposited in the network. In addition, AAVE moved to the base, a block network owned by coinbass and voting is ongoing to be activated that on the line.

Avena forecast prices

AAVE price has strong technical indicators that propose a potential set in the coming months. He formed a glass and hand pattern of chart, with the upper border to $ 400. Recent return is part of the formation of the handle, which usually follow a powerful jump.

AAVE also formed a small pattern of checks checks, signals that the handle phase can be completed, which could lead to further profits. The depth cup is about 90%, and the measurement of the same distance from the upper limit suggests that the coin could switch to 765 dollars in the long run, increasing 200% of its current level.

https://crypto.news/app/uploads/2023/11/crypto-news-protocol-Aave04.webp

2025-02-07 22:36:00